Summary

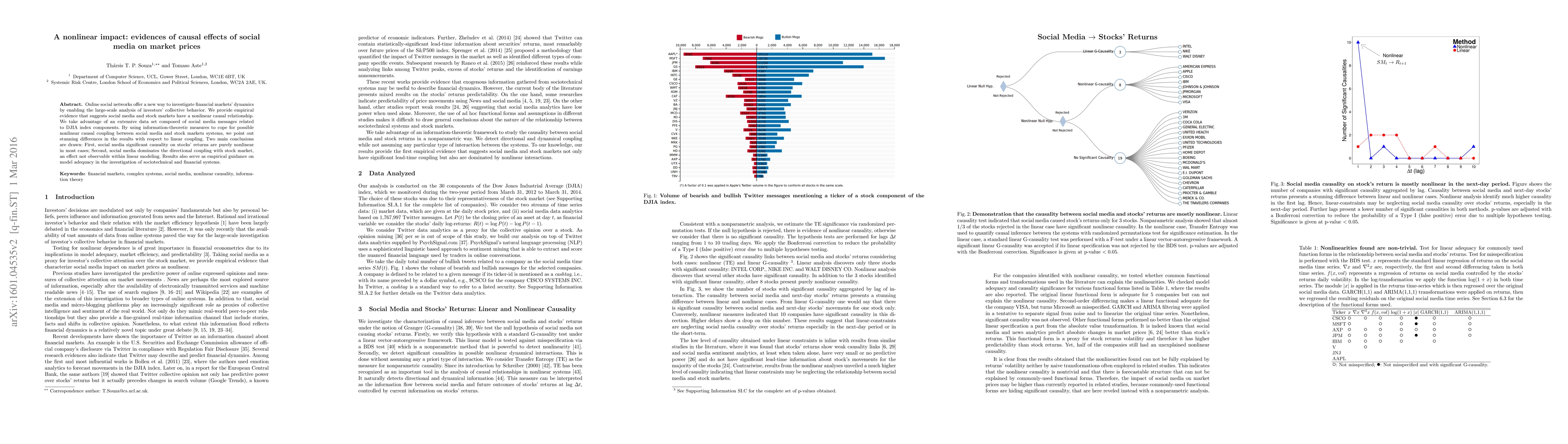

Online social networks offer a new way to investigate financial markets' dynamics by enabling the large-scale analysis of investors' collective behavior. We provide empirical evidence that suggests social media and stock markets have a nonlinear causal relationship. We take advantage of an extensive data set composed of social media messages related to DJIA index components. By using information-theoretic measures to cope for possible nonlinear causal coupling between social media and stock markets systems, we point out stunning differences in the results with respect to linear coupling. Two main conclusions are drawn: First, social media significant causality on stocks' returns are purely nonlinear in most cases; Second, social media dominates the directional coupling with stock market, an effect not observable within linear modeling. Results also serve as empirical guidance on model adequacy in the investigation of sociotechnical and financial systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEvaluating Impact of Social Media Posts by Executives on Stock Prices

Sudip Kumar Naskar, Sohom Ghosh, Swagata Chakraborty et al.

Tweet Influence on Market Trends: Analyzing the Impact of Social Media Sentiment on Biotech Stocks

C. Sarai R. Avila

Do we actually understand the impact of renewables on electricity prices? A causal inference approach

Pierre Pinson, Davide Cacciarelli, Filip Panagiotopoulos et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)