Summary

The Accardi-Boukas quantum Black-Scholes equation can be used as an alternative to the classical approach to finance, and has been found to have a number of useful benefits. The quantum Kolmogorov backward equations, and associated quantum Fokker-Planck equations, that arise from this general framework, are derived using the Hudson-Parthasarathy quantum stochastic calculus. In this paper we show how these equations can be derived using a nonlocal approach to quantum mechanics. We show how nonlocal diffusions, and quantum stochastic processes can be linked, and discuss how moment matching can be used for deriving solutions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

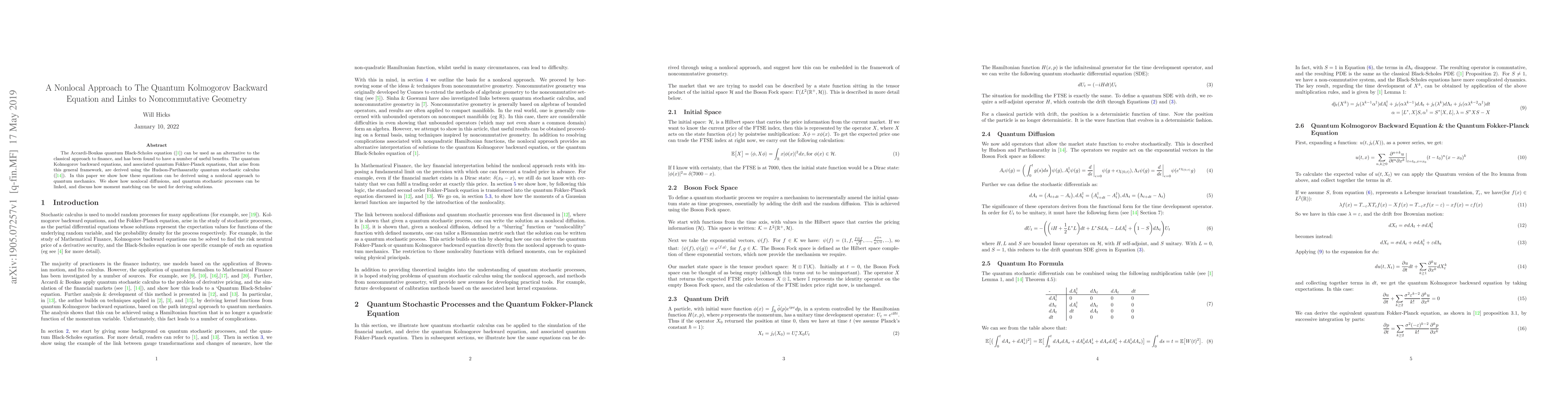

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)