Summary

We propose a novel Dirichlet-based P\'olya tree (D-P tree) prior on the copula and based on the D-P tree prior, a nonparametric Bayesian inference procedure. Through theoretical analysis and simulations, we are able to show that the flexibility of the D-P tree prior ensures its consistency in copula estimation, thus able to detect more subtle and complex copula structures than earlier nonparametric Bayesian models, such as a Gaussian copula mixture. Further, the continuity of the imposed D-P tree prior leads to a more favorable smoothing effect in copula estimation over classic frequentist methods, especially with small sets of observations. We also apply our method to the copula prediction between the S\&P 500 index and the IBM stock prices during the 2007-08 financial crisis, finding that D-P tree-based methods enjoy strong robustness and flexibility over classic methods under such irregular market behaviors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

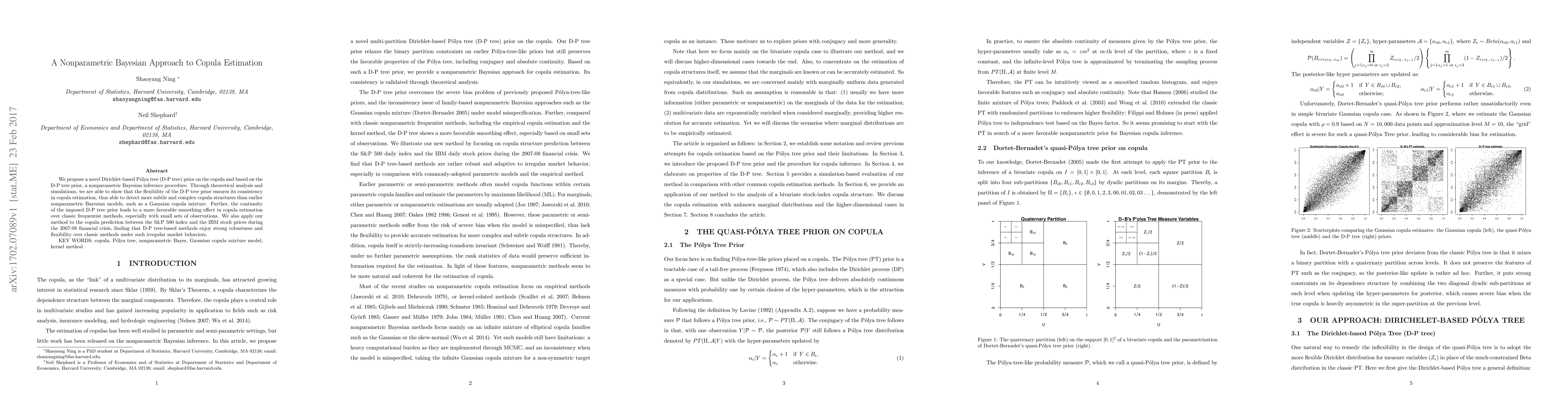

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Predictive Approach to Bayesian Nonparametric Survival Analysis

Edwin Fong, Brieuc Lehmann

| Title | Authors | Year | Actions |

|---|

Comments (0)