Summary

Bitcoin as well as other cryptocurrencies are all plagued by the impact from bifurcation. Since the marginal cost of bifurcation is theoretically zero, it causes the coin holders to doubt on the existence of the coin's intrinsic value. This paper suggests a normative dual-value theory to assess the fundamental value of Bitcoin. We draw on the experience from the art market, where similar replication problems are prevalent. The idea is to decompose the total value of a cryptocurrency into two parts: one is its art value and the other is its use value. The tradeoff between these two values is also analyzed, which enlightens our proposal of an image coin for Bitcoin so as to elevate its use value without sacrificing its art value. To show the general validity of the dual-value theory, we also apply it to evaluate the prospects of four major cryptocurrencies. We find this framework is helpful for both the investors and the exchanges to examine a new coin's value when it first appears in the market.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper proposes a normative dual-value theory for Bitcoin and other cryptocurrencies, drawing on the art market's experience with replication problems. It decomposes a cryptocurrency's total value into art value and use value, analyzing their tradeoff.

Key Results

- The dual-value theory helps assess the fundamental value of Bitcoin and other cryptocurrencies.

- Bitcoin's intrinsic value can be linked to its art value, which is stored in its original algorithm.

- The use value of Bitcoin is limited by its original design of 1M block size, potentially causing a 'glass ceiling'.

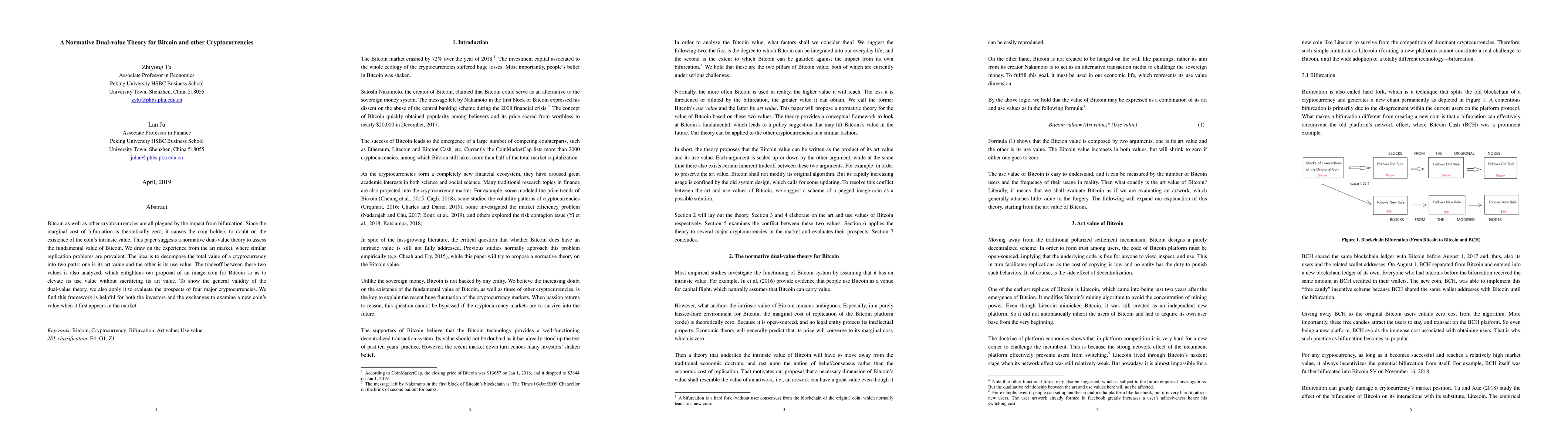

- An image coin, Bitcoin Mirror (BTCM), is proposed to boost Bitcoin's use value without affecting its art value.

- The dual-value theory can be applied to evaluate other cryptocurrencies, like BCH, ETH, and EOS.

Significance

This research is important as it addresses the issue of intrinsic value doubts caused by bifurcations in cryptocurrencies, offering a framework for investors and exchanges to evaluate new coins.

Technical Contribution

The paper introduces a normative dual-value theory for cryptocurrencies, decomposing their total value into art and use values, and proposes an image coin (BTCM) to address the use value limitations of Bitcoin.

Novelty

The dual-value theory offers a novel approach to understanding and valuing cryptocurrencies, distinguishing it from previous research that primarily focuses on technical or economic aspects without considering the art value dimension.

Limitations

- The study does not provide extensive empirical tests for the proposed dual-value theory.

- The success of the proposed Bitcoin Mirror (BTCM) remains to be seen in practice.

Future Work

- Further empirical testing of the dual-value theory for various cryptocurrencies.

- Exploration of the long-term impact and adoption of the proposed Bitcoin Mirror (BTCM).

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSummarizing and Analyzing the Privacy-Preserving Techniques in Bitcoin and other Cryptocurrencies

Chaitanya Rahalkar, Anushka Virgaonkar

BitMLx: Secure Cross-chain Smart Contracts For Bitcoin-style Cryptocurrencies

Pedro Moreno-Sanchez, Federico Badaloni, Clara Schneidewind et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)