Summary

Simple exponential smoothing is widely used in forecasting economic time series. This is because it is quick to compute and it generally delivers accurate forecasts. On the other hand, its multivariate version has received little attention due to the complications arising with the estimation. Indeed, standard multivariate maximum likelihood methods are affected by numerical convergence issues and bad complexity, growing with the dimensionality of the model. In this paper, we introduce a new estimation strategy for multivariate exponential smoothing, based on aggregating its observations into scalar models and estimating them. The original high-dimensional maximum likelihood problem is broken down into several univariate ones, which are easier to solve. Contrary to the multivariate maximum likelihood approach, the suggested algorithm does not suffer heavily from the dimensionality of the model. The method can be used for time series forecasting. In addition, simulation results show that our approach performs at least as well as a maximum likelihood estimator on the underlying VMA(1) representation, at least in our test problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

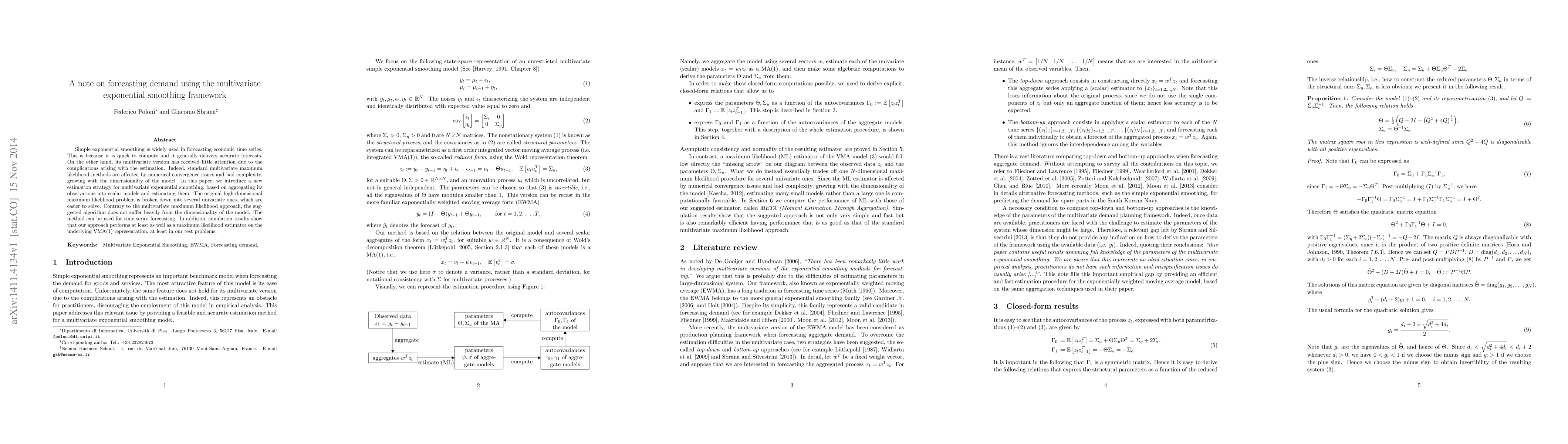

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersETSformer: Exponential Smoothing Transformers for Time-series Forecasting

Doyen Sahoo, Chenghao Liu, Gerald Woo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)