Summary

We consider an insurance entity endowed with an initial capital and a surplus process modelled as a Brownian motion with drift. It is assumed that the company seeks to maximise the cumulated value of expected discounted dividends, which are declared or paid in a foreign currency. The currency fluctuation is modelled as a L\'evy process. We consider both cases: restricted and unrestricted dividend payments. It turns out that the value function and the optimal strategy can be calculated explicitly.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

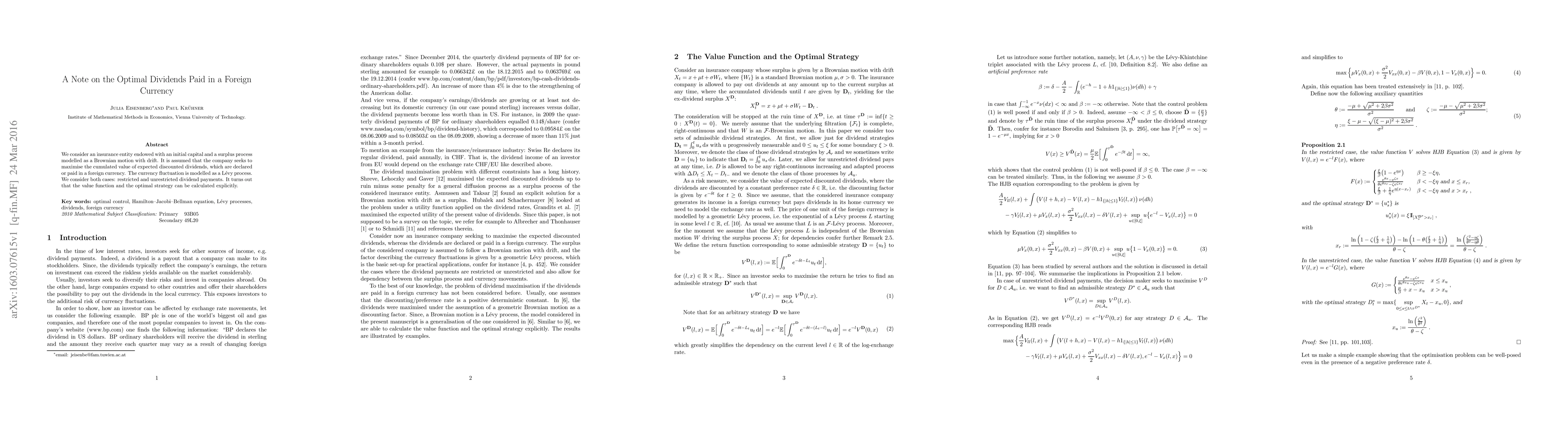

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)