Summary

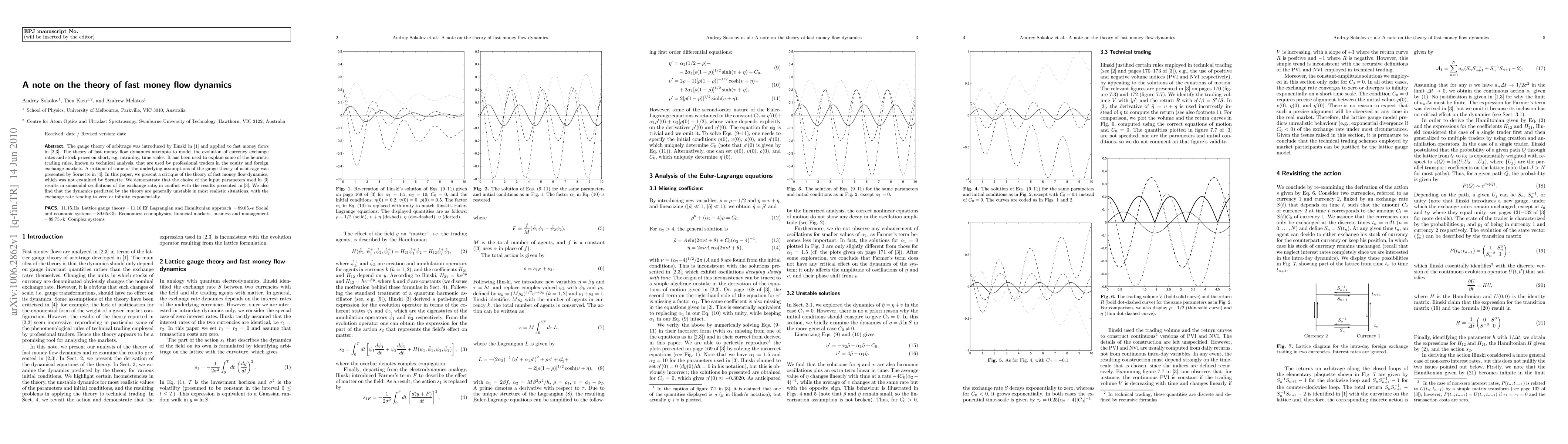

The gauge theory of arbitrage was introduced by Ilinski in [arXiv:hep-th/9710148] and applied to fast money flows in [arXiv:cond-mat/9902044]. The theory of fast money flow dynamics attempts to model the evolution of currency exchange rates and stock prices on short, e.g.\ intra-day, time scales. It has been used to explain some of the heuristic trading rules, known as technical analysis, that are used by professional traders in the equity and foreign exchange markets. A critique of some of the underlying assumptions of the gauge theory of arbitrage was presented by Sornette in [arXiv:cond-mat/9804045]. In this paper, we present a critique of the theory of fast money flow dynamics, which was not examined by Sornette. We demonstrate that the choice of the input parameters used in [arXiv:cond-mat/9902044] results in sinusoidal oscillations of the exchange rate, in conflict with the results presented in [arXiv:cond-mat/9902044]. We also find that the dynamics predicted by the theory are generally unstable in most realistic situations, with the exchange rate tending to zero or infinity exponentially.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)