Summary

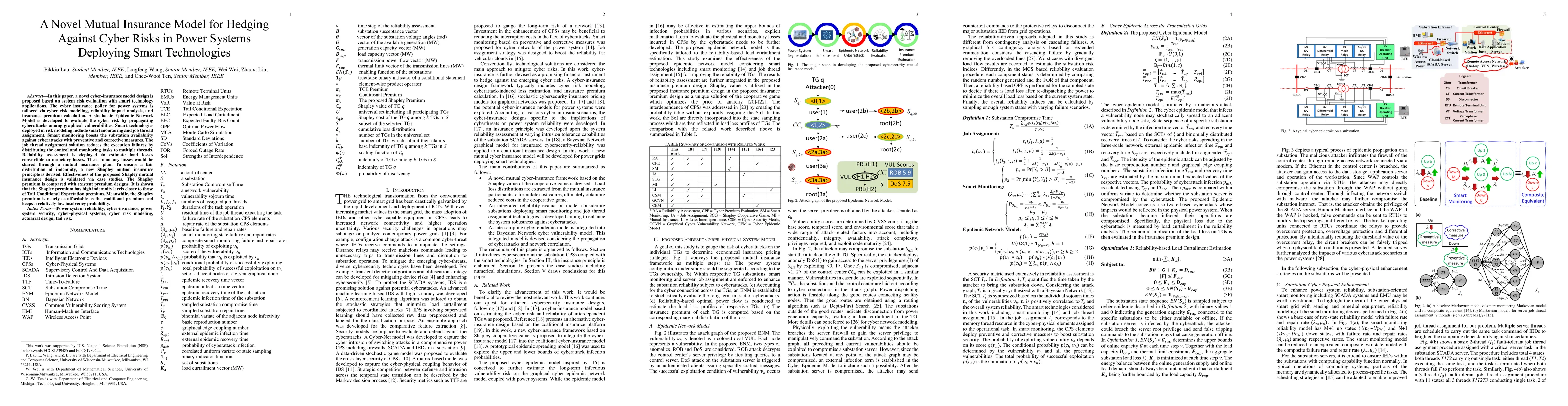

In this paper, a novel cyber-insurance model design is proposed based on system risk evaluation with smart technology applications. The cyber insurance policy for power systems is tailored via cyber risk modeling, reliability impact analysis, and insurance premium calculation. A stochastic Epidemic Network Model is developed to evaluate the cyber risk by propagating cyberattacks among graphical vulnerabilities. Smart technologies deployed in risk modeling include smart monitoring and job thread assignment. Smart monitoring boosts the substation availability against cyberattacks with preventive and corrective measures. The job thread assignment solution reduces the execution failures by distributing the control and monitoring tasks to multiple threads. Reliability assessment is deployed to estimate load losses convertible to monetary losses. These monetary losses would be shared through a mutual insurance plan. To ensure a fair distribution of indemnity, a new Shapley mutual insurance principle is devised. Effectiveness of the proposed Shapley mutual insurance design is validated via case studies. The Shapley premium is compared with existent premium designs. It is shown that the Shapley premium has high indemnity levels closer to those of Tail Conditional Expectation premium. Meanwhile, the Shapley premium is nearly as affordable as the coalitional premium and keeps a relatively low insolvency probability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Novel Efficient Signcryption Scheme for Resource-Constrained Smart Terminals in Cyber-Physical Power Systems

Cheng Jiang, Lei Wu, Xue Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)