Summary

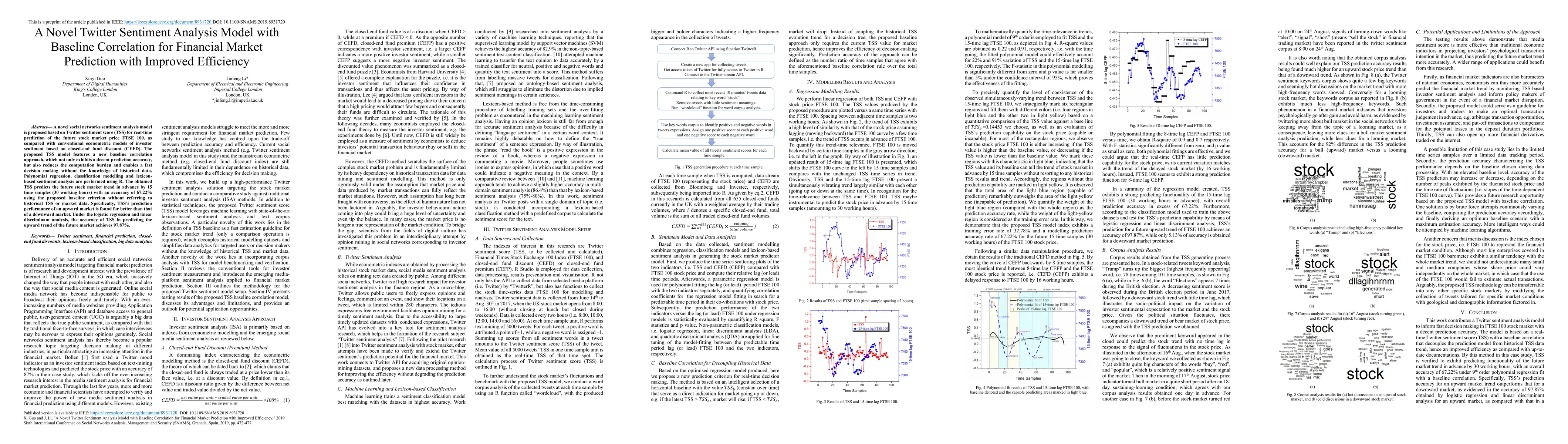

A novel social networks sentiment analysis model is proposed based on Twitter sentiment score (TSS) for real-time prediction of the future stock market price FTSE 100, as compared with conventional econometric models of investor sentiment based on closed-end fund discount (CEFD). The proposed TSS model features a new baseline correlation approach, which not only exhibits a decent prediction accuracy, but also reduces the computation burden and enables a fast decision making without the knowledge of historical data. Polynomial regression, classification modelling and lexicon-based sentiment analysis are performed using R. The obtained TSS predicts the future stock market trend in advance by 15 time samples (30 working hours) with an accuracy of 67.22% using the proposed baseline criterion without referring to historical TSS or market data. Specifically, TSS's prediction performance of an upward market is found far better than that of a downward market. Under the logistic regression and linear discriminant analysis, the accuracy of TSS in predicting the upward trend of the future market achieves 97.87%.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMore than Words: Twitter Chatter and Financial Market Sentiment

Travis Adams, Andrea Ajello, Diego Silva et al.

Transforming Sentiment Analysis in the Financial Domain with ChatGPT

Georgios Makridis, Georgios Fatouros, John Soldatos et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)