Authors

Summary

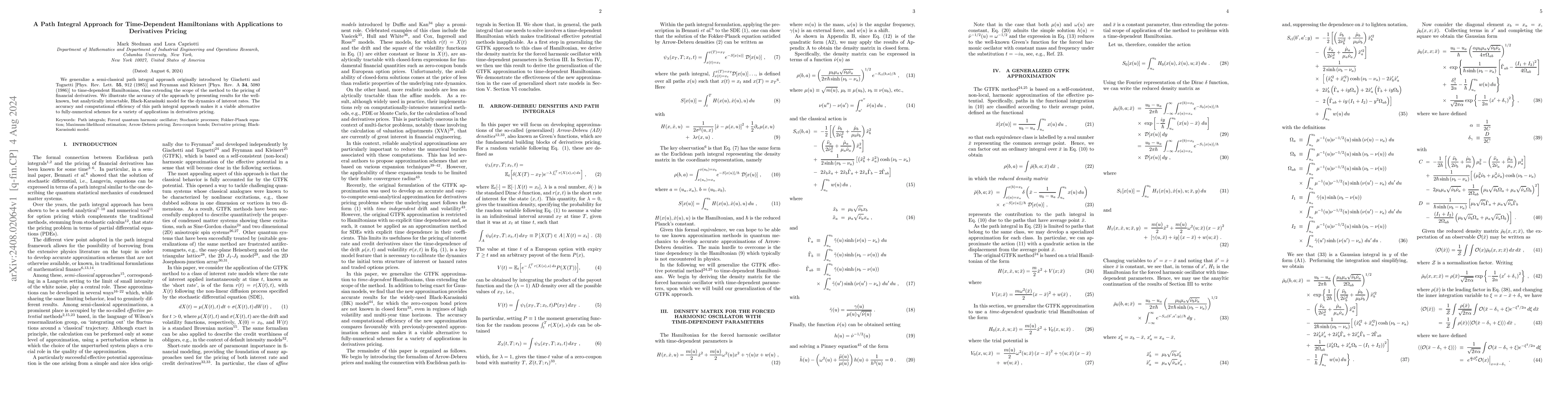

We generalize a semi-classical path integral approach originally introduced by Giachetti and Tognetti [Phys. Rev. Lett. 55, 912 (1985)] and Feynman and Kleinert [Phys. Rev. A 34, 5080 (1986)] to time-dependent Hamiltonians, thus extending the scope of the method to the pricing of financial derivatives. We illustrate the accuracy of the approach by presenting results for the well-known, but analytically intractable, Black-Karasinski model for the dynamics of interest rates. The accuracy and computational efficiency of this path integral approach makes it a viable alternative to fully-numerical schemes for a variety of applications in derivatives pricing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)