Summary

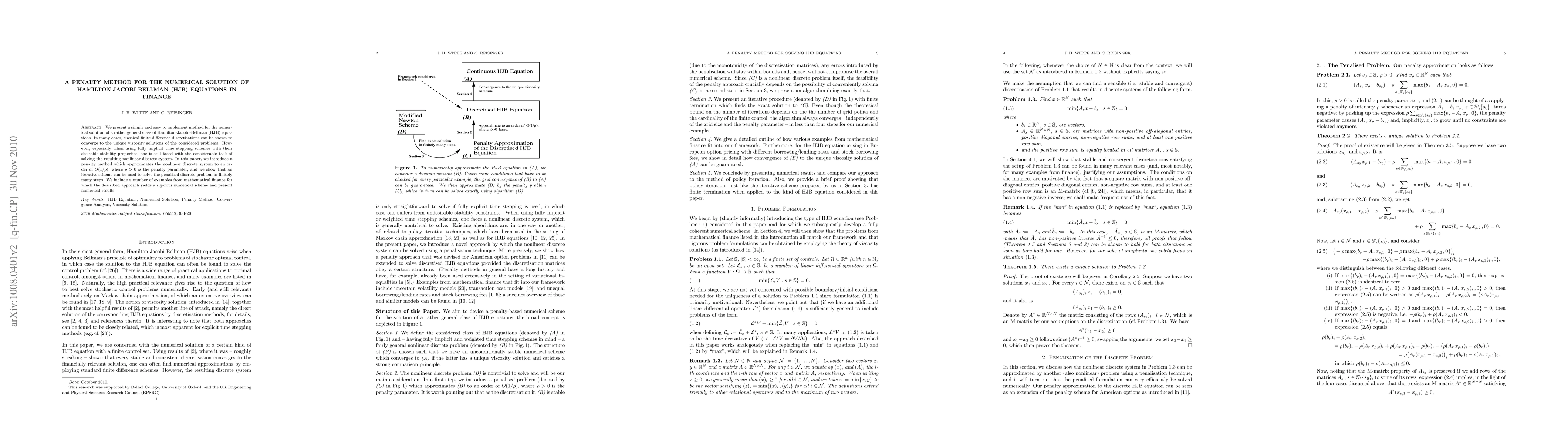

We present a simple and easy to implement method for the numerical solution of a rather general class of Hamilton-Jacobi-Bellman (HJB) equations. In many cases, the considered problems have only a viscosity solution, to which, fortunately, many intuitive (e.g. finite difference based) discretisations can be shown to converge. However, especially when using fully implicit time stepping schemes with their desirable stability properties, one is still faced with the considerable task of solving the resulting nonlinear discrete system. In this paper, we introduce a penalty method which approximates the nonlinear discrete system to first order in the penalty parameter, and we show that an iterative scheme can be used to solve the penalised discrete problem in finitely many steps. We include a number of examples from mathematical finance for which the described approach yields a rigorous numerical scheme and present numerical results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)