Authors

Summary

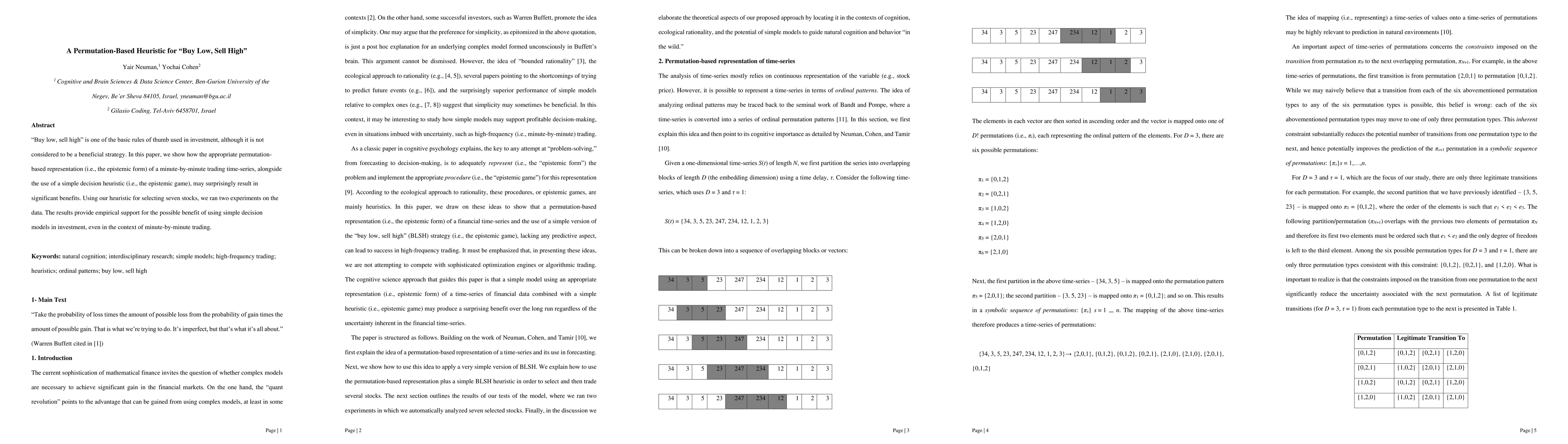

Buy low, sell high is one of the basic rules of thumb used in investment, although it is not considered to be a beneficial strategy. In this paper, we show how the appropriate permutation-based representation (i.e., the epistemic form) of a minute-by-minute trading time-series, alongside the use of a simple decision heuristic (i.e., the epistemic game), may surprisingly result in significant benefits. Using our heuristic for selecting seven stocks, we ran two experiments on the data. The results provide empirical support for the possible benefit of using simple decision models in investment, even in the context of minute-by-minute trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)