Authors

Summary

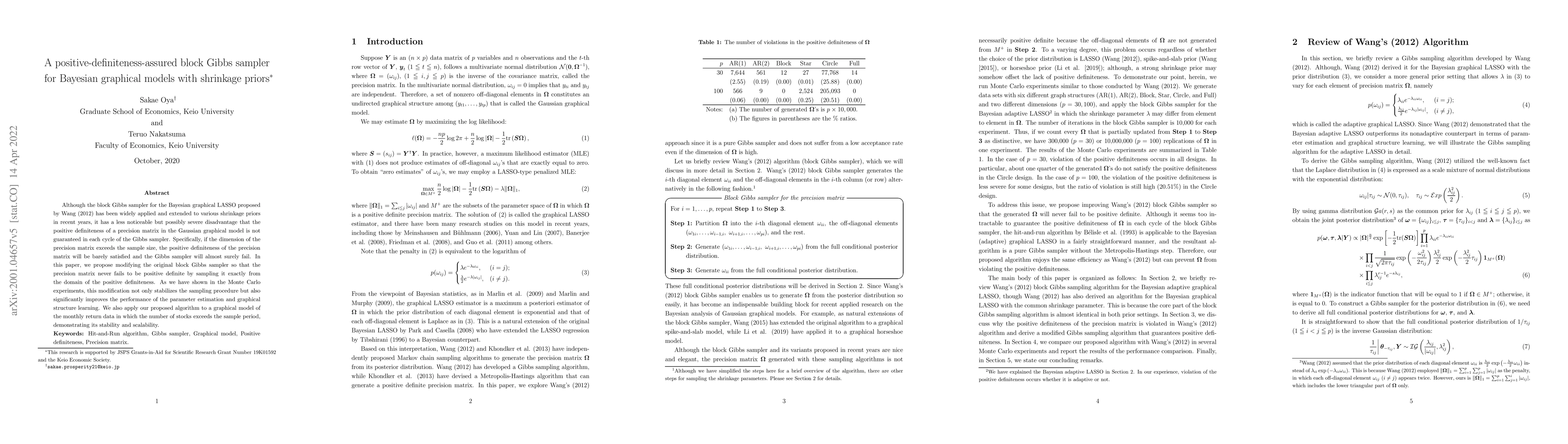

Although the block Gibbs sampler for the Bayesian graphical LASSO proposed by Wang (2012) has been widely applied and extended to various shrinkage priors in recent years, it has a less noticeable but possibly severe disadvantage that the positive definiteness of a precision matrix in the Gaussian graphical model is not guaranteed in each cycle of the Gibbs sampler. Specifically, if the dimension of the precision matrix exceeds the sample size, the positive definiteness of the precision matrix will be barely satisfied and the Gibbs sampler will almost surely fail. In this paper, we propose modifying the original block Gibbs sampler so that the precision matrix never fails to be positive definite by sampling it exactly from the domain of the positive definiteness. As we have shown in the Monte Carlo experiments, this modification not only stabilizes the sampling procedure but also significantly improves the performance of the parameter estimation and graphical structure learning. We also apply our proposed algorithm to a graphical model of the monthly return data in which the number of stocks exceeds the sample period, demonstrating its stability and scalability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)