Summary

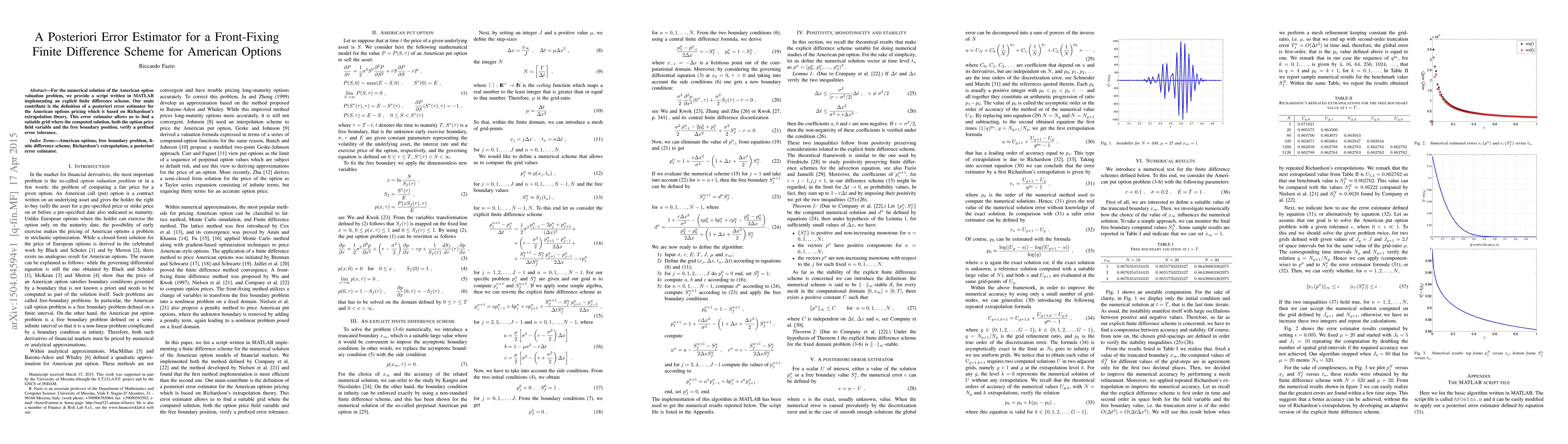

For the numerical solution of the American option valuation problem, we provide a script written in MATLAB implementing an explicit finite difference scheme. Our main contribute is the definition of a posteriori error estimator for the American options pricing which is based on Richardson's extrapolation theory. This error estimator allows us to find a suitable grid where the computed solution, both the option price field variable and the free boundary position, verify a prefixed error tolerance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)