Summary

In this paper we study the optimization problem of an economic agent who chooses a job and the time of retirement as well as consumption and portfolio of assets. The agent is constrained in the ability to borrow against future income. We transform the problem into a dual two-person zero-sum game, which involves a controller, who is a minimizer and chooses a non-increasing process, and a stopper, who is a maximizer and chooses a stopping time. We derive the Hamilton-Jacobi- Bellman quasi-variational inequality(HJBQV) of a max-min type arising from the game. We provide a solution to the HJBQV and verification that it is the value of the game. We establish a duality result which allows to derive the optimal strategies and value function of the primal problem from those of the dual problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

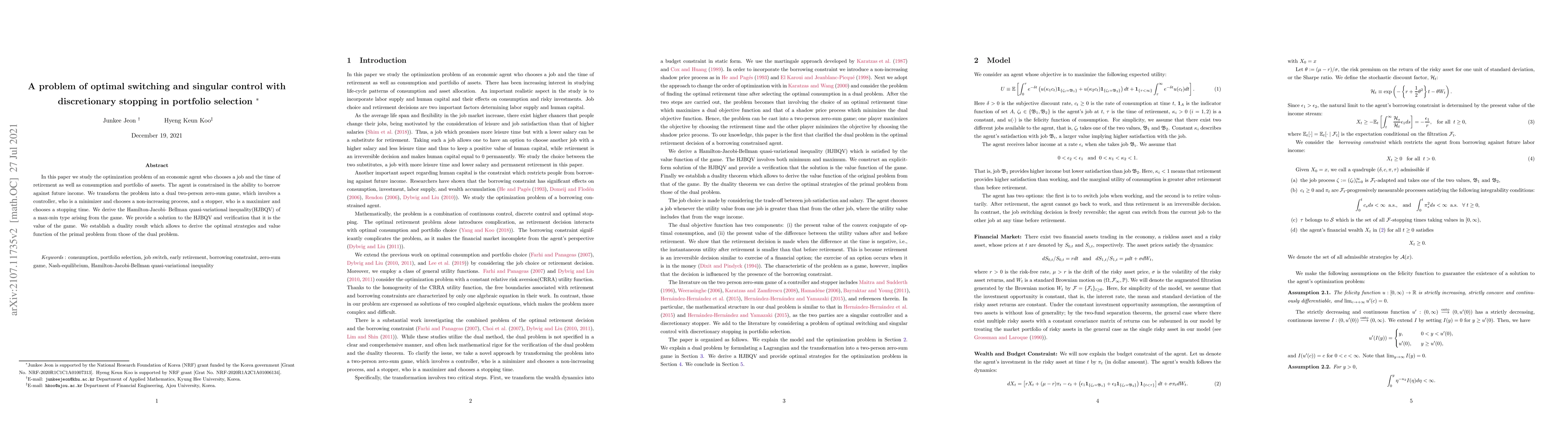

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA sequential estimation problem with control and discretionary stopping

Erik Ekström, Ioannis Karatzas

The one-shot problem: Solution to an open question of finite-fuel singular control with discretionary stopping

Neofytos Rodosthenous, John Moriarty

Dynamic programming principle for classical and singular stochastic control with discretionary stopping

Alessandro Milazzo, Tiziano De Angelis

No citations found for this paper.

Comments (0)