Authors

Summary

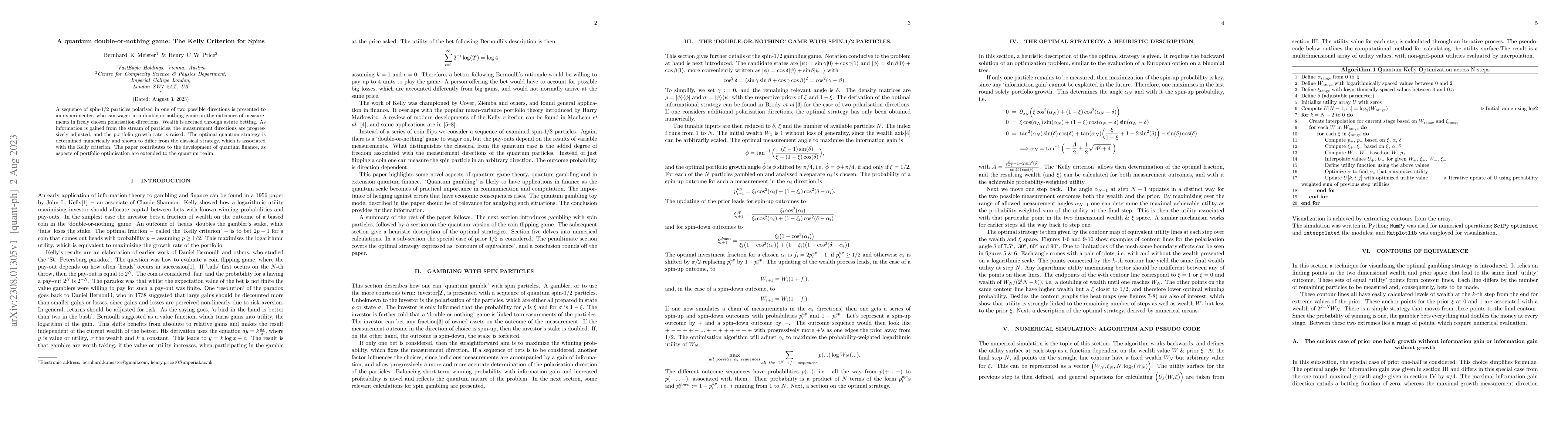

A sequence of spin-1/2 particles polarised in one of two possible directions is presented to an experimenter, who can wager in a double-or-nothing game on the outcomes of measurements in freely chosen polarisation directions. Wealth is accrued through astute betting. As information is gained from the stream of particles, the measurement directions are progressively adjusted, and the portfolio growth rate is raised. The optimal quantum strategy is determined numerically and shown to differ from the classical strategy, which is associated with the Kelly criterion. The paper contributes to the development of quantum finance, as aspects of portfolio optimisation are extended to the quantum realm.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)