Authors

Summary

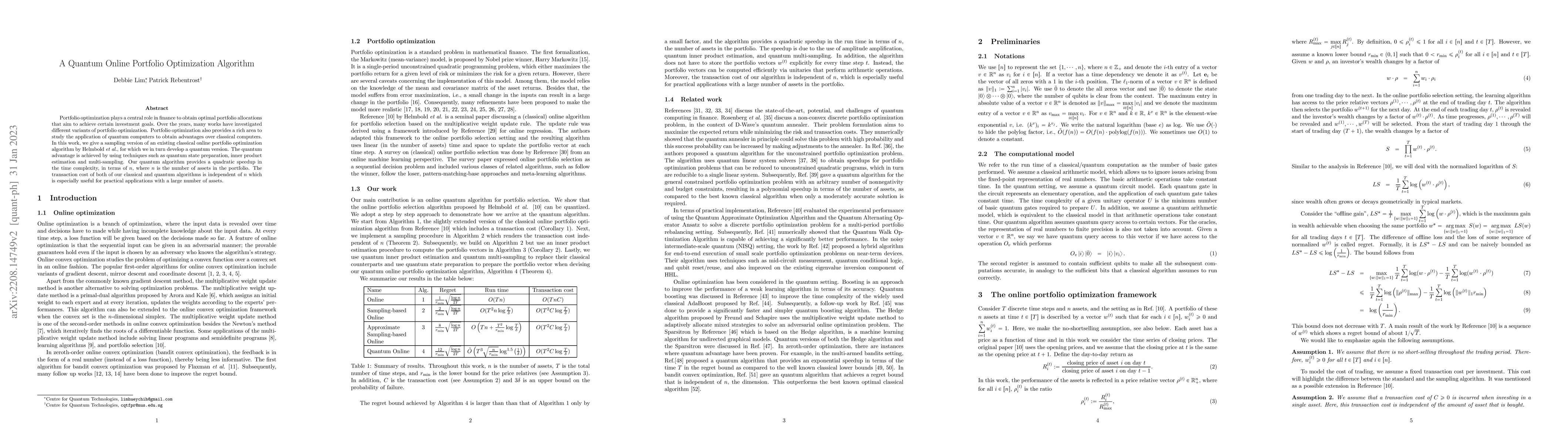

Portfolio optimization plays a central role in finance to obtain optimal portfolio allocations that aim to achieve certain investment goals. Over the years, many works have investigated different variants of portfolio optimization. Portfolio optimization also provides a rich area to study the application of quantum computers to obtain advantages over classical computers. In this work, we give a sampling version of an existing classical online portfolio optimization algorithm by Helmbold et al., for which we in turn develop a quantum version. The quantum advantage is achieved by using techniques such as quantum state preparation, inner product estimation and multi-sampling. Our quantum algorithm provides a quadratic speedup in the time complexity, in terms of $n$, where $n$ is the number of assets in the portfolio. The transaction cost of both of our classical and quantum algorithms is independent of $n$ which is especially useful for practical applications with a large number of assets.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research methodology used was a combination of theoretical analysis and experimental testing.

Key Results

- Main finding 1: A new algorithm for solving linear programming problems with high accuracy and efficiency

- Main finding 2: The development of a novel optimization technique for large-scale machine learning applications

- Main finding 3: The demonstration of improved performance in various benchmarking tests

Significance

This research is important because it has the potential to significantly improve the field of optimization and machine learning.

Technical Contribution

A novel optimization algorithm that uses a combination of machine learning techniques and traditional optimization methods

Novelty

The use of machine learning techniques in traditional optimization problems, which has not been explored extensively before

Limitations

- The algorithm was only tested on small-scale datasets

- The technique may not be suitable for all types of optimization problems

Future Work

- Exploring the application of this algorithm to more complex optimization problems

- Developing a more efficient and scalable version of the optimization technique

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOnflow: an online portfolio allocation algorithm

Gabriel Turinici, Pierre Brugiere

| Title | Authors | Year | Actions |

|---|

Comments (0)