Authors

Summary

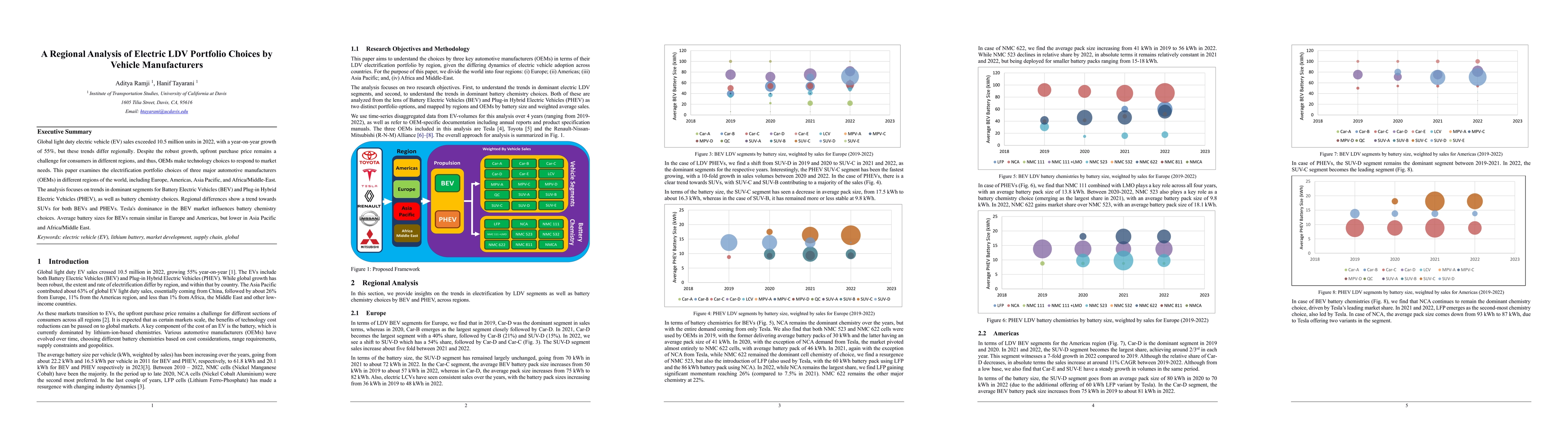

Global light duty electric vehicle (EV) sales exceeded 10.5 million units in 2022, with a year-on-year growth of 55%, but these trends differ regionally. Despite the robust growth, upfront purchase price remains a challenge for consumers in different regions, and thus, OEMs make technology choices to respond to market needs. This paper examines the electrification portfolio choices of three major automotive manufacturers (OEMs) in different regions of the world, including Europe, Americas, Asia Pacific, and Africa/Middle-East. The analysis focuses on trends in dominant segments for Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV), as well as battery chemistry choices. Regional differences show a trend towards SUVs for both BEVs and PHEVs. Tesla's dominance in the BEV market influences battery chemistry choices. Average battery sizes for BEVs remain similar in Europe and Americas, but lower in Asia Pacific and Africa/Middle East.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrajectory-Integrated Accessibility Analysis of Public Electric Vehicle Charging Stations

Jinhua Zhao, Jiaman Wu, Scott J. Moura et al.

No citations found for this paper.

Comments (0)