Summary

A regularized vector autoregressive hidden semi-Markov model is developed to analyze multivariate financial time series with switching data generating regimes. Furthermore, an augmented EM algorithm is proposed for parameter estimation by embedding regularized estimators for the state-dependent covariance matrices and autoregression matrices in the M-step. The performance of the proposed regularized estimators is evaluated both in the simulation experiments and on the New York Stock Exchange financial portfolio data.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper develops a regularized Vector Autoregressive Hidden Semi-Markov Model (VAR(p)-HSMM) for analyzing multivariate financial time series with switching data generating regimes. It proposes an augmented Expectation-Maximization (EM) algorithm for parameter estimation, incorporating regularized estimators for state-dependent covariance and autoregression matrices.

Key Results

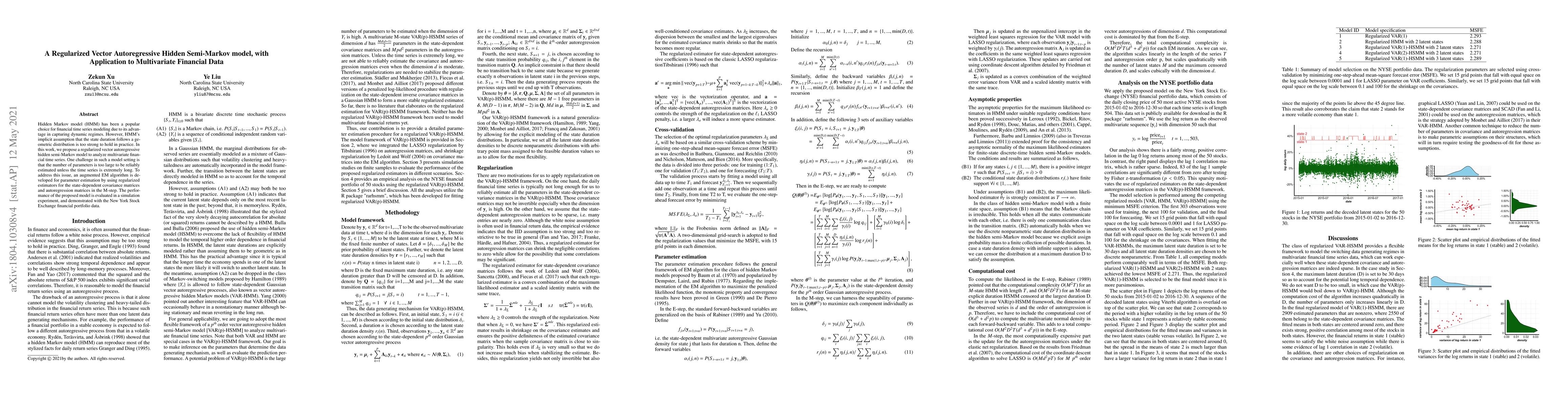

- The proposed regularized estimators are evaluated through simulation experiments and applied to New York Stock Exchange (NYSE) financial portfolio data.

- The model demonstrates improved performance in estimating parameters compared to unregularized methods, especially in scenarios with high-dimensional data and limited time series length.

- Empirical analysis on the NYSE financial portfolio data shows that the regularized VAR(1)-HSMM with 2 states achieves the lowest mean-square forecast error (MSFE) of 2.271, outperforming competing models like regularized VAR, HMM, and VAR(2)-HSMM.

Significance

This research is significant as it provides a robust framework for modeling multivariate financial time series data with switching regimes, which is crucial for accurate forecasting and risk management in finance.

Technical Contribution

The paper's main technical contribution is the integration of LASSO regularization for autoregression matrices and shrinkage regularization for covariance matrices within the EM algorithm for estimating parameters in the VAR(p)-HSMM framework.

Novelty

This work stands out by addressing the challenge of parameter instability in high-dimensional multivariate financial time series with switching regimes, proposing a regularized estimation procedure that ensures reliable parameter estimates even with limited time series length.

Limitations

- The method relies on specific assumptions about the underlying data generating process, such as Gaussian noise and discrete state durations.

- Computational complexity increases with the number of latent states and maximum censored duration, which may limit its application to very large datasets or high-dimensional time series.

Future Work

- Exploring alternative regularization techniques, such as graphical Lasso for covariance matrices or SCAD for autoregression matrices, could further enhance the model's performance.

- Investigating the application of the proposed method to other domains with similar data characteristics, like economic indicators or energy markets, could broaden its practical relevance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)