Summary

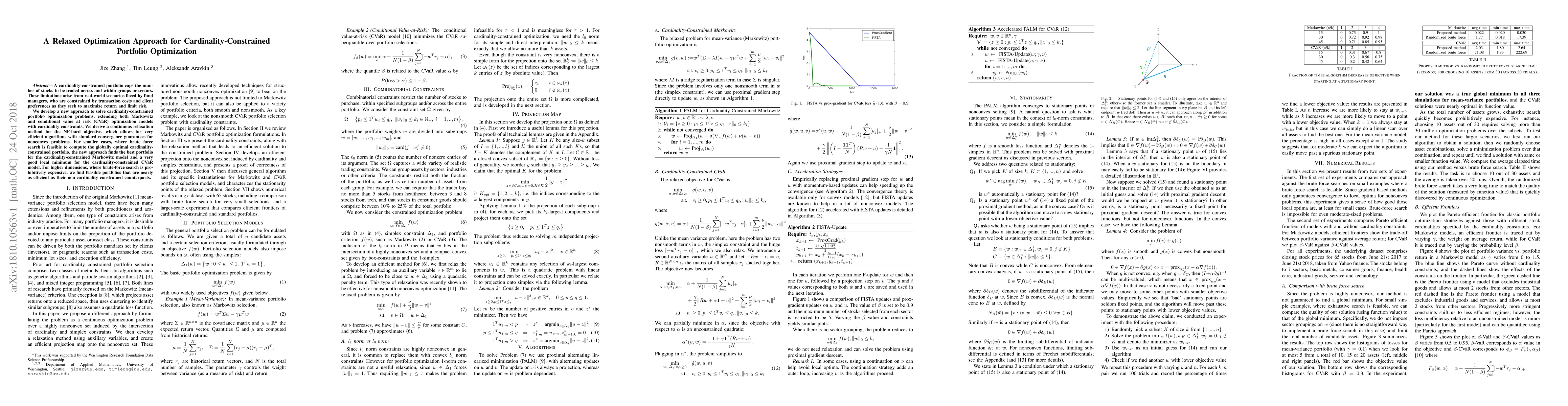

A cardinality-constrained portfolio caps the number of stocks to be traded across and within groups or sectors. These limitations arise from real-world scenarios faced by fund managers, who are constrained by transaction costs and client preferences as they seek to maximize return and limit risk. We develop a new approach to solve cardinality-constrained portfolio optimization problems, extending both Markowitz and conditional value at risk (CVaR) optimization models with cardinality constraints. We derive a continuous relaxation method for the NP-hard objective, which allows for very efficient algorithms with standard convergence guarantees for nonconvex problems. For smaller cases, where brute force search is feasible to compute the globally optimal cardinality- constrained portfolio, the new approach finds the best portfolio for the cardinality-constrained Markowitz model and a very good local minimum for the cardinality-constrained CVaR model. For higher dimensions, where brute-force search is prohibitively expensive, we find feasible portfolios that are nearly as efficient as their non-cardinality constrained counterparts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCardinality-constrained Distributionally Robust Portfolio Optimization

Yuichi Takano, Ken Kobayashi, Kazuhide Nakata

A low-cost alternating projection approach for a continuous formulation of convex and cardinality constrained optimization

Nataša Krejić, Marcos Raydan, Evelin H. M. Krulikovski

| Title | Authors | Year | Actions |

|---|

Comments (0)