Authors

Summary

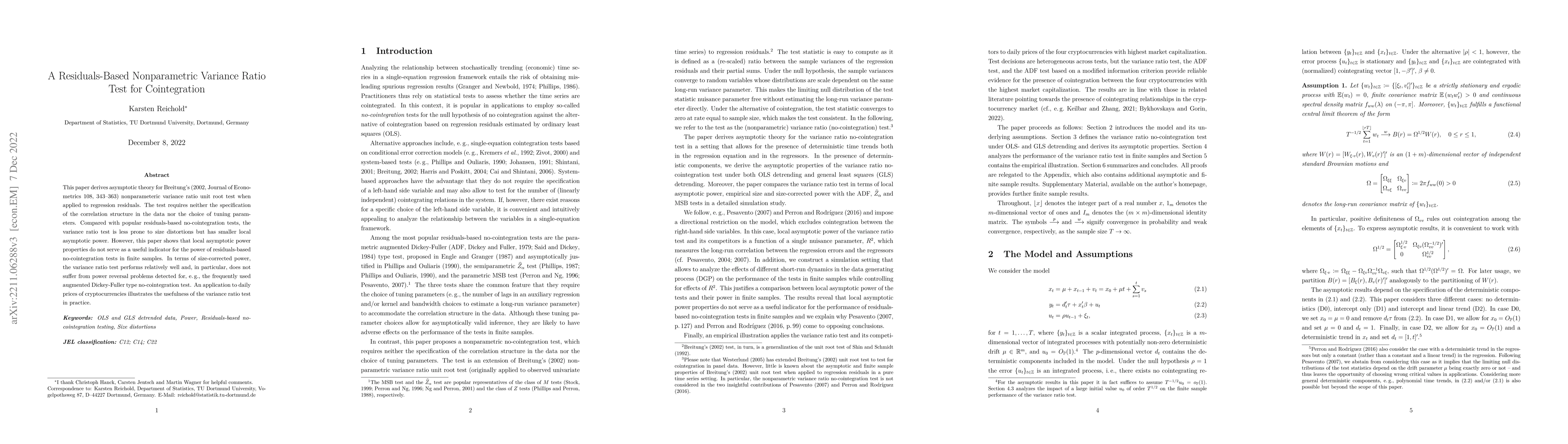

This paper derives asymptotic theory for Breitung's (2002, Journal of Econometrics 108, 343-363) nonparameteric variance ratio unit root test when applied to regression residuals. The test requires neither the specification of the correlation structure in the data nor the choice of tuning parameters. Compared with popular residuals-based no-cointegration tests, the variance ratio test is less prone to size distortions but has smaller local asymptotic power. However, this paper shows that local asymptotic power properties do not serve as a useful indicator for the power of residuals-based no-cointegration tests in finite samples. In terms of size-corrected power, the variance ratio test performs relatively well and, in particular, does not suffer from power reversal problems detected for, e.g., the frequently used augmented Dickey-Fuller type no-cointegration test. An application to daily prices of cryptocurrencies illustrates the usefulness of the variance ratio test in practice.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)