Summary

We propose a risk measurement approach for a risk-averse stochastic problem. We provide results that guarantee that our problem has a solution. We characterize and explore the properties of the argmin as a risk measure and the minimum as a deviation measure. We provide a connection between linear regression models and our framework. Based on this conception, we consider conditional risk and provide a connection between the minimum deviation portfolio and linear regression. Moreover, we also link the optimal replication hedging to our framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

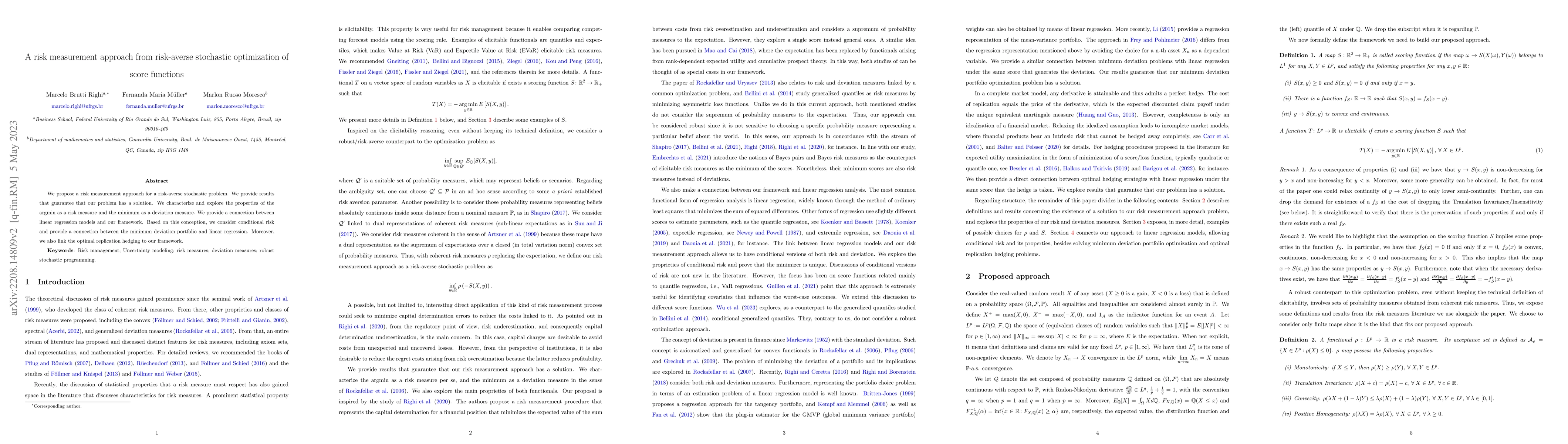

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExpectiles In Risk Averse Stochastic Programming and Dynamic Optimization

Rajmadan Lakshmanan, Alois Pichler

Randomized quasi-Monte Carlo methods for risk-averse stochastic optimization

Johannes Milz, Olena Melnikov

| Title | Authors | Year | Actions |

|---|

Comments (0)