Summary

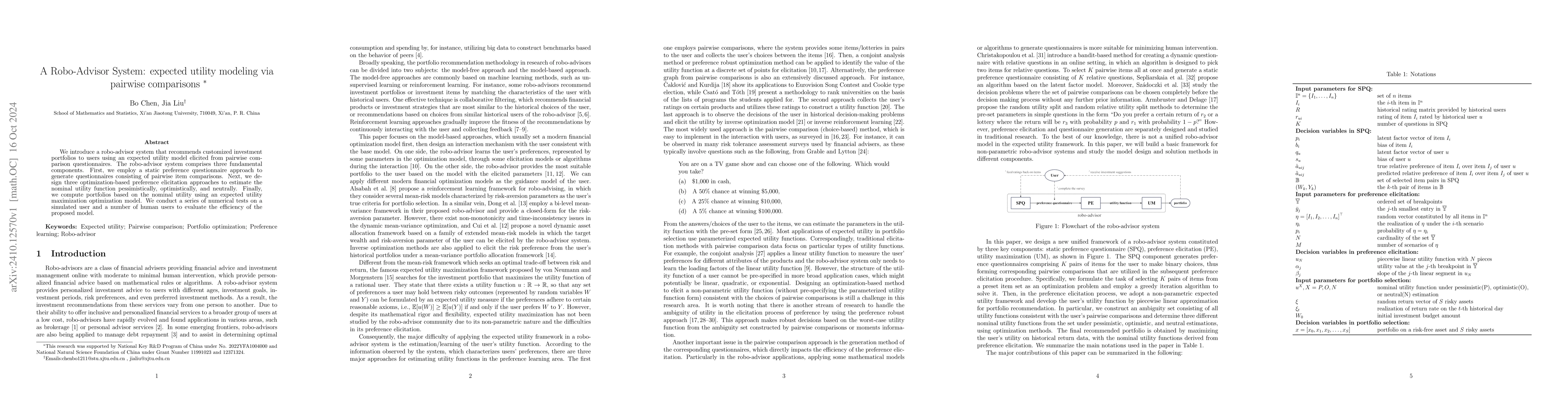

We introduce a robo-advisor system that recommends customized investment portfolios to users using an expected utility model elicited from pairwise comparison questionnaires. The robo-advisor system comprises three fundamental components. First, we employ a static preference questionnaire approach to generate questionnaires consisting of pairwise item comparisons. Next, we design three optimization-based preference elicitation approaches to estimate the nominal utility function pessimistically, optimistically, and neutrally. Finally, we compute portfolios based on the nominal utility using an expected utility maximization optimization model. We conduct a series of numerical tests on a simulated user and a number of human users to evaluate the efficiency of the proposed model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)