Authors

Summary

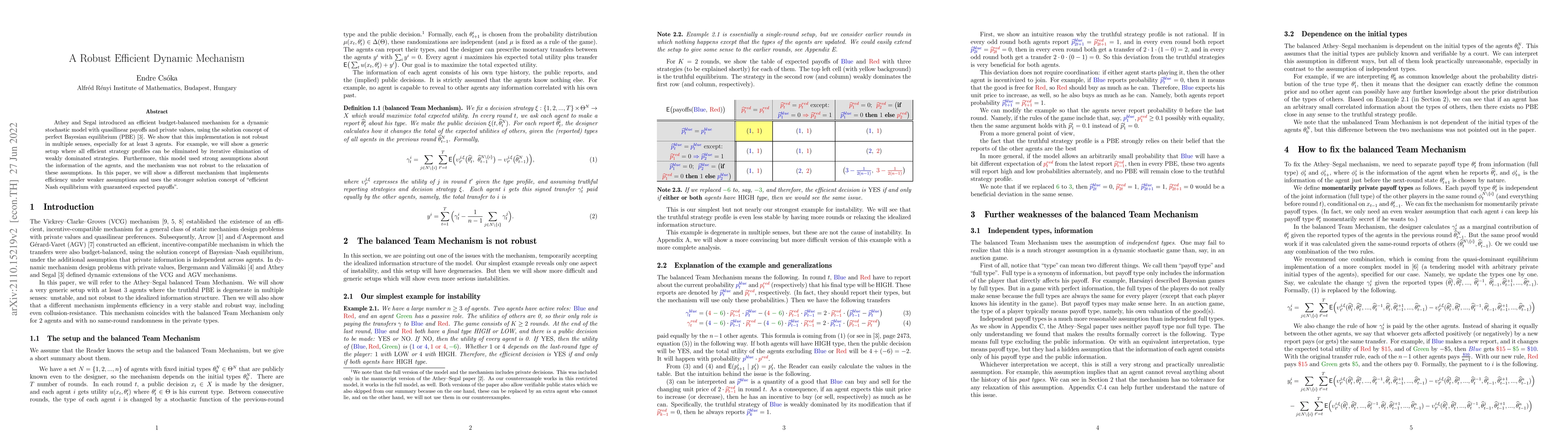

Athey and Segal introduced an efficient budget-balanced mechanism for a dynamic stochastic model with quasilinear payoffs and private values, using the solution concept of perfect Bayesian equilibrium. We show that this implementation is not robust in multiple senses, especially for at least 3 agents. For example, we will show a generic setup where all efficient strategy profiles can be eliminated by iterative elimination of weakly dominated strategies. Furthermore, this model used strong assumptions about the information of the agents, and the mechanism was not robust to the relaxation of these assumptions. In this paper, we will show a different mechanism that implements efficiency under weaker assumptions and uses the stronger solution concept of ``efficient Nash equilibrium with guaranteed expected payoffs''.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHyperdimensional Hashing: A Robust and Efficient Dynamic Hash Table

Mike Heddes, Igor Nunes, Tony Givargis et al.

DBPF: A Framework for Efficient and Robust Dynamic Bin-Picking

Yunhui Liu, Masayoshi Tomizuka, Rui Cao et al.

A topological mechanism for robust and efficient global oscillations in biological networks

Chongbin Zheng, Evelyn Tang

An Efficient Dynamic Transaction Storage Mechanism for Sustainable High Throughput Bitcoin

Xiongfei Zhao, Gerui Zhang, Yain-Whar Si

No citations found for this paper.

Comments (0)