Authors

Summary

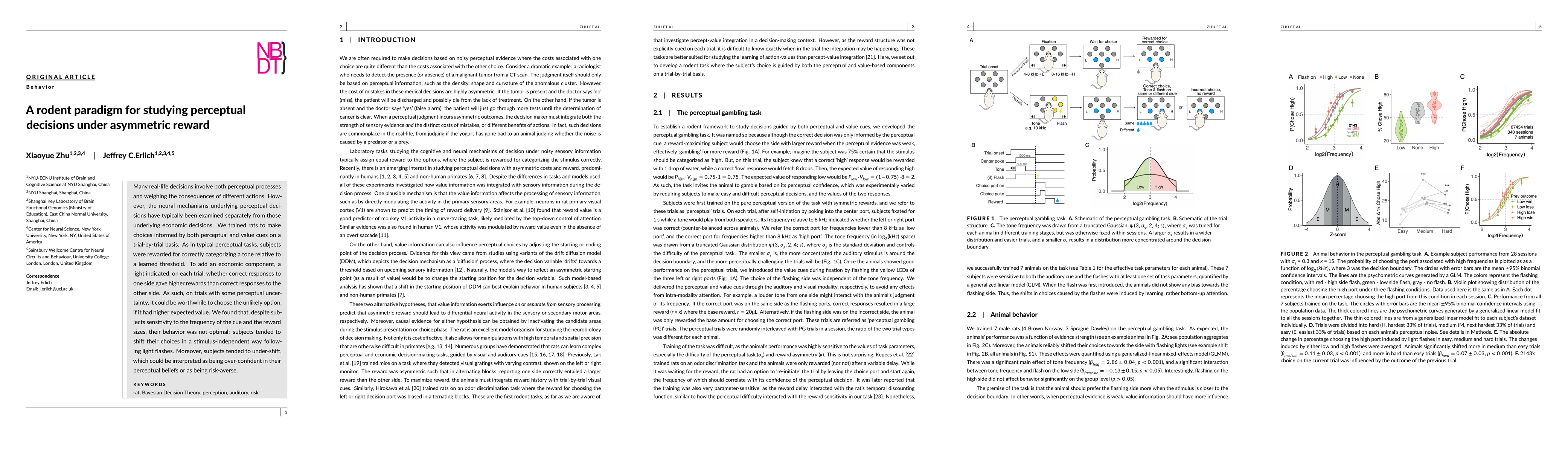

Many real-life decisions involve both perceptual processes and weighing the consequences of different actions. However, the neural mechanisms underlying perceptual decisions have typically been examined separately from those underlying economic decisions. Here, we trained rats to make choices informed by both perceptual and value cues on a trial-by-trial basis. As in typical perceptual tasks, subjects were rewarded for correctly categorizing a tone relative to a learned threshold. To add an economic component, a light indicated, on each trial, whether correct responses to one side gave higher rewards than correct responses to the other side. As such, on trials with some perceptual uncertainty, it could be worthwhile to choose the unlikely option, if it had higher expected value. We found that, despite subjects sensitivity to the frequency of the cue and the reward sizes, their behavior was not optimal: subjects tended to shift their choices in a stimulus-independent way following light flashes. Moreover, subjects tended to under-shift, which could be interpreted as being over-confident in their perceptual beliefs or as being risk-averse.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA canonical gated neural circuit model for flexible perceptual decisions

Wong-Lin, K., Bhattacharyya, S., Azimi, A. et al.

No citations found for this paper.

Comments (0)