Summary

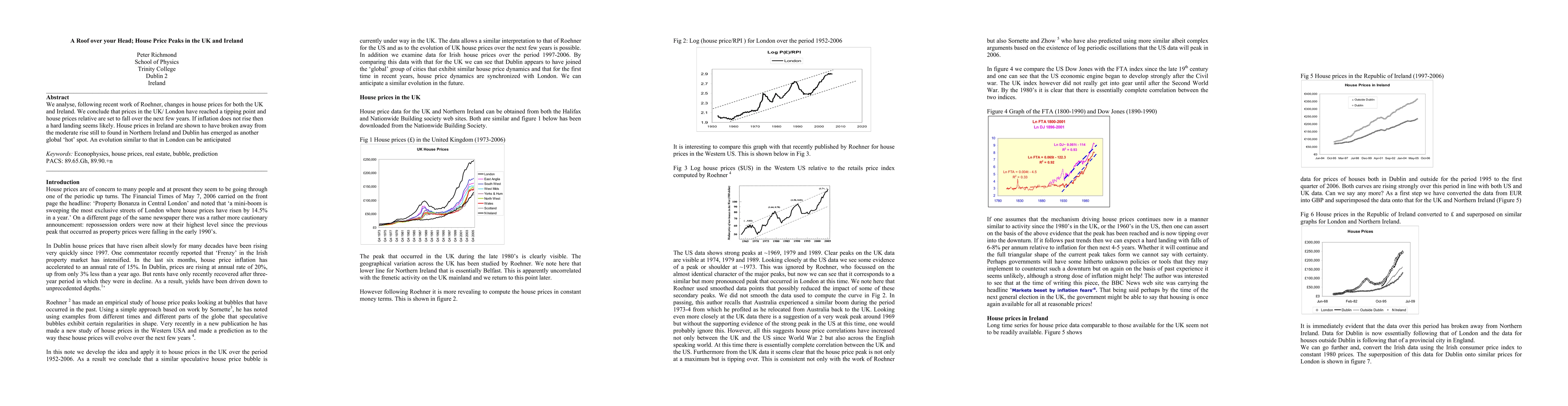

We analyse, following recent work of Roehner, changes in house prices for both the UK and Ireland. We conclude that prices in London have reached a tipping point and prices relative to inflation are set to fall over the next few years. If inflation does not rise then a hard landing seems likely. House prices in the Irish Republic are shown to have broken away from the moderate rise still to be found in Northern Ireland and Dublin has emerged as another global 'hot spot'. An evolution of Dublin house prices similar to that in London can be anticipated. Keywords: Econophysics, house prices, real estate, prediction PACS: 89.65.Gh, 89.90.+n

AI Key Findings

Generated Sep 05, 2025

Methodology

The research uses econophysics to analyze house prices in the UK and Ireland.

Key Results

- House prices in London have reached a tipping point and are set to fall over the next few years if inflation does not rise.

- Prices relative to inflation are expected to decline in Dublin, making it another global 'hot spot'.

- House prices in Northern Ireland are still experiencing moderate growth.

Significance

This research is important as it provides insight into the UK and Irish housing markets and their potential impact on the economy.

Technical Contribution

The research contributes to our understanding of econophysics and its application to real estate markets.

Novelty

This study uses an innovative approach to analyze the UK and Irish housing markets, providing new insights into their dynamics.

Limitations

- The study only analyzes historical data, which may not accurately predict future trends.

- The econophysics approach used in this research may be limited by its complexity.

Future Work

- Further analysis of the UK and Irish housing markets using machine learning algorithms.

- Investigating the impact of government policies on house prices in these countries.

- Developing a more comprehensive model to predict house price fluctuations.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBoosting House Price Estimations with Multi-Head Gated Attention

Cosimo Distante, Abdelmalik Taleb-Ahmed, Zakaria Abdellah Sellam et al.

Quantum communications feasibility tests over a UK-Ireland 224-km undersea link

Ayan Biswas, Ben Amies-King, Karolina P. Schatz et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)