Summary

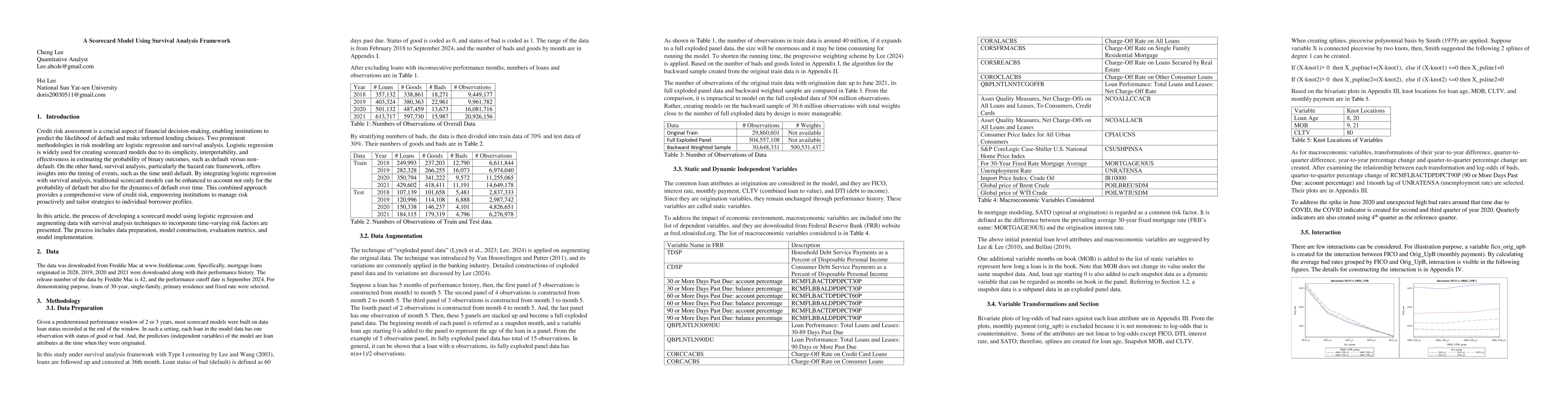

Credit risk assessment is a crucial aspect of financial decision-making, enabling institutions to predict the likelihood of default and make informed lending choices. Two prominent methodologies in risk modeling are logistic regression and survival analysis. Logistic regression is widely used for creating scorecard models due to its simplicity, interpretability, and effectiveness in estimating the probability of binary outcomes, such as default versus non-default. On the other hand, survival analysis, particularly the hazard rate framework, offers insights into the timing of events, such as the time until default. By integrating logistic regression with survival analysis, traditional scorecard models can be enhanced to account not only for the probability of default but also for the dynamics of default over time. This combined approach provides a comprehensive view of credit risk, empowering institutions to manage risk proactively and tailor strategies to individual borrower profiles. In this article, the process of developing a scorecard model using logistic regression and augmenting data with survival analysis techniques to incorporate time-varying risk factors are presented. The process includes data preparation, model construction, evaluation metrics, and model implementation.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research integrates logistic regression with survival analysis techniques to develop a scorecard model for credit risk assessment, enhancing traditional models by accounting for the timing of default events.

Key Results

- A combined logistic regression and survival analysis model was successfully developed and validated.

- The model effectively predicts monthly bad rates, aligning with hazard rates in survival analysis.

- Parameter estimates identified key variables positively contributing to bad rates (DTI, CLTV, SATO, origination interest rate, FICO_Orig_UpB, percentage change in 90 days past due, lagged unemployment rate, and COVID index) and negatively contributing (FICO, quarter 1 and quarter 3 indices).

Significance

This research provides a comprehensive credit risk assessment model that enables financial institutions to proactively manage risk and tailor strategies to individual borrower profiles, improving lending decisions and risk management.

Technical Contribution

The paper presents a novel approach to credit risk modeling by merging logistic regression with survival analysis techniques, providing a more comprehensive view of credit risk dynamics.

Novelty

This research distinguishes itself by combining traditional logistic regression with survival analysis, offering a more nuanced understanding of credit risk by incorporating time-varying risk factors and the timing of default events.

Limitations

- The model is currently limited to predicting the performance of existing loans, as it was built using booked applicants only.

- The study did not explore the model's applicability to different types of loans or diverse borrower demographics.

Future Work

- Expand the model to include rejected applicant data for building a loan origination model.

- Investigate the model's performance and applicability across various loan types and borrower demographics.

- Explore the integration of additional macroeconomic variables to further refine risk predictions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAI Data Development: A Scorecard for the System Card Framework

Ioannis A. Kakadiaris, Haileleol Tibebu, Tadesse K. Bahiru

SurvUnc: A Meta-Model Based Uncertainty Quantification Framework for Survival Analysis

Yu Liu, Tong Xia, Tingting Zhu et al.

No citations found for this paper.

Comments (0)