Summary

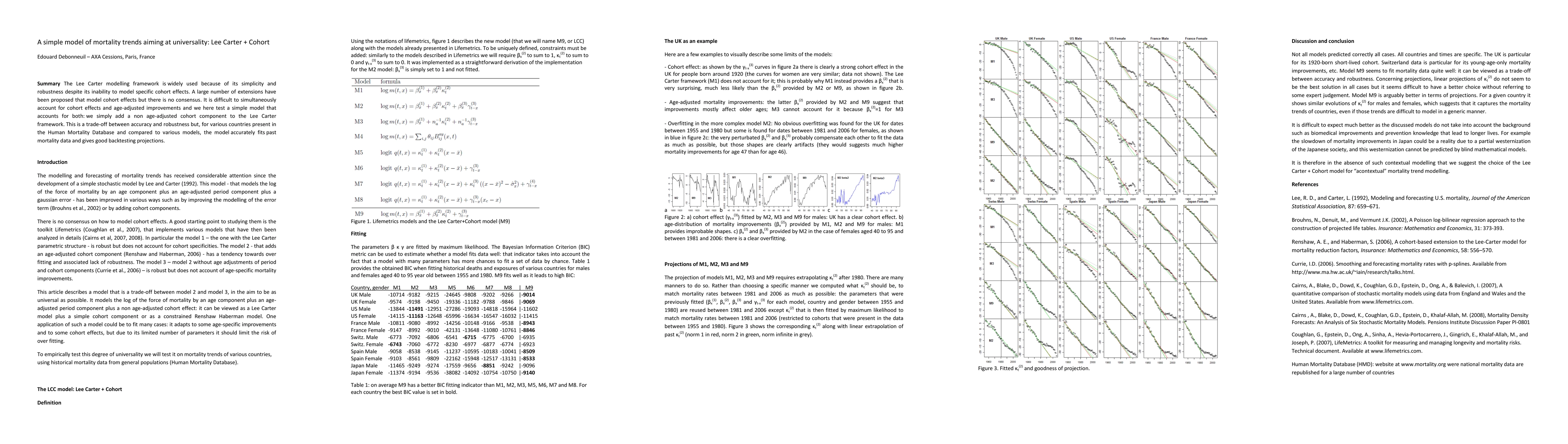

The Lee Carter modelling framework is widely used because of its simplicity and robustness despite its inability to model specific cohort effects. A large number of extensions have been proposed that model cohort effects but there is no consensus. It is difficult to simultaneously account for cohort effects and age-adjusted improvements and we here test a simple model that accounts for both: we simply add a non age-adjusted cohort component to the Lee Carter framework. This is a trade-off between accuracy and robustness but, for various countries present in the Human Mortality Database and compared to various models, the model accurately fits past mortality data and gives good backtesting projections.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)