Summary

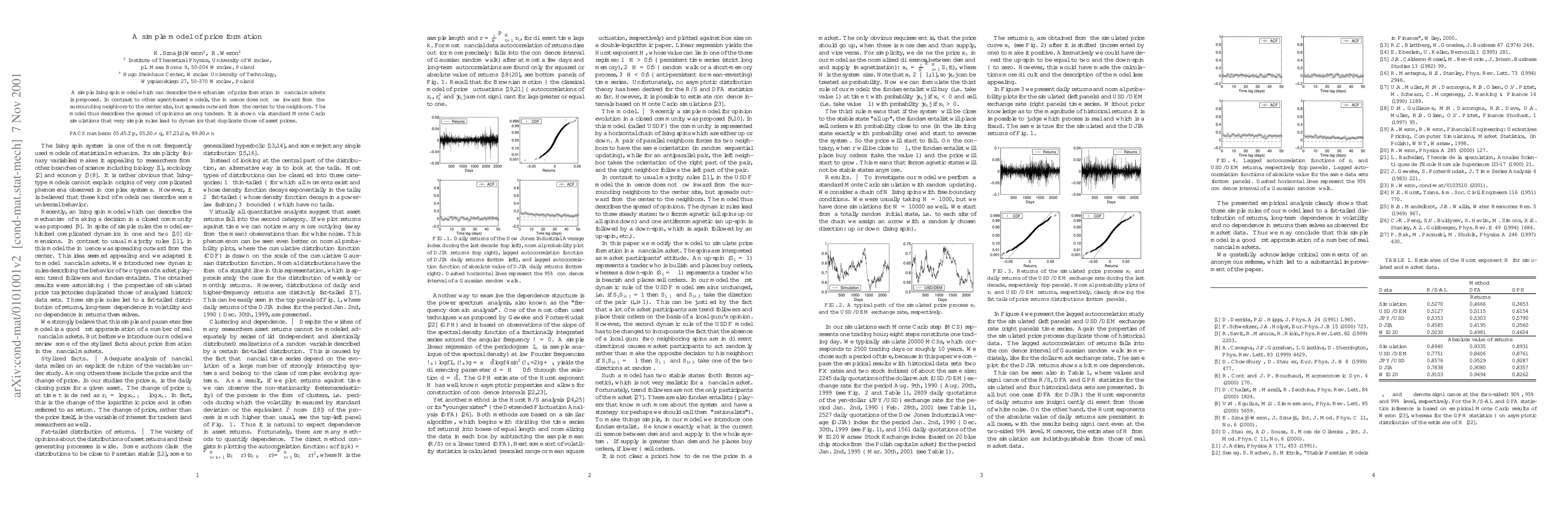

A simple Ising spin model which can describe the mechanism of price formation in financial markets is proposed. In contrast to other agent-based models, the influence does not flow inward from the surrounding neighbors to the center site, but spreads outward from the center to the neighbors. The model thus describes the spread of opinions among traders. It is shown via standard Monte Carlo simulations that very simple rules lead to dynamics that duplicate those of asset prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)