Authors

Summary

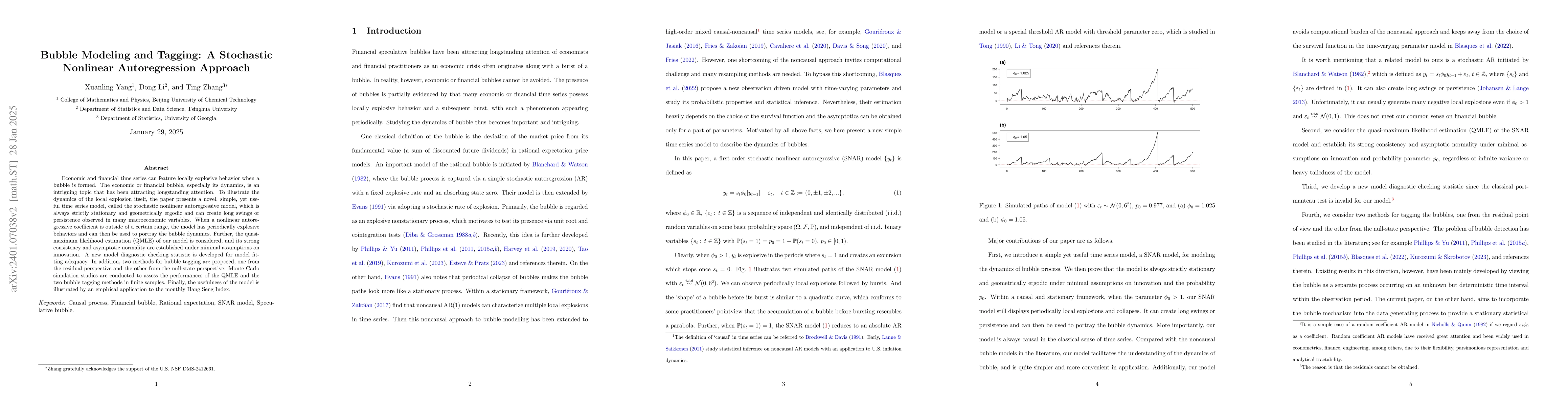

Economic and financial time series can feature locally explosive behavior when a bubble is formed. The economic or financial bubble, especially its dynamics, is an intriguing topic that has been attracting longstanding attention. To illustrate the dynamics of the local explosion itself, the paper presents a novel, simple, yet useful time series model, called the stochastic nonlinear autoregressive model, which is always strictly stationary and geometrically ergodic and can create long swings or persistence observed in many macroeconomic variables. When a nonlinear autoregressive coefficient is outside of a certain range, the model has periodically explosive behaviors and can then be used to portray the bubble dynamics. Further, the quasi-maximum likelihood estimation (QMLE) of our model is considered, and its strong consistency and asymptotic normality are established under minimal assumptions on innovation. A new model diagnostic checking statistic is developed for model fitting adequacy. In addition two methods for bubble tagging are proposed, one from the residual perspective and the other from the null-state perspective. Monte Carlo simulation studies are conducted to assess the performances of the QMLE and the two bubble tagging methods in finite samples. Finally, the usefulness of the model is illustrated by an empirical application to the monthly Hang Seng Index.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersBubble $^{36}$Ar and Its New Breathing Modes

Yu-Gang Ma, Xi-Guang Cao, Ge Ren et al.

No citations found for this paper.

Comments (0)