Summary

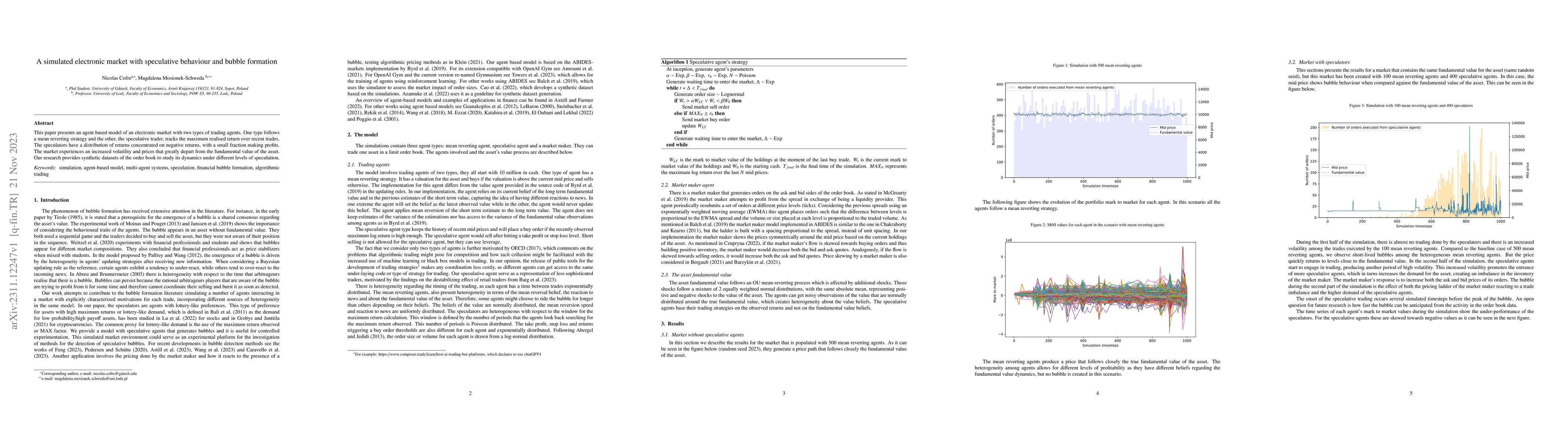

This paper presents an agent based model of an electronic market with two types of trading agents. One type follows a mean reverting strategy and the other, the speculative trader, tracks the maximum realised return over recent trades. The speculators have a distribution of returns concentrated on negative returns, with a small fraction making profits. The market experiences an increased volatility and prices that greatly depart from the fundamental value of the asset. Our research provides synthetic datasets of the order book to study its dynamics under different levels of speculation

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSpeculative bubbles and crashes in stock market: an interacting-agent model of speculative activity

Taisei Kaizoji

Interrogation of A Bubble in the Indian Market

Ganapathy G Gangadharan, N. Suresh

No citations found for this paper.

Comments (0)