Summary

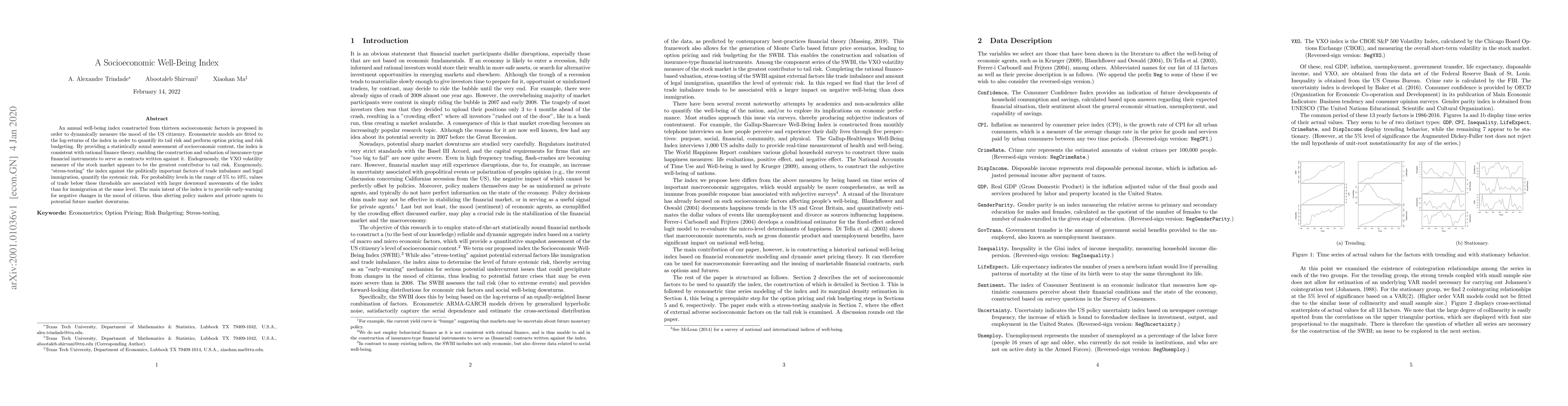

An annual well-being index constructed from thirteen socioeconomic factors is proposed in order to dynamically measure the mood of the US citizenry. Econometric models are fitted to the log-returns of the index in order to quantify its tail risk and perform option pricing and risk budgeting. By providing a statistically sound assessment of socioeconomic content, the index is consistent with rational finance theory, enabling the construction and valuation of insurance-type financial instruments to serve as contracts written against it. Endogenously, the VXO volatility measure of the stock market appears to be the greatest contributor to tail risk. Exogenously, "stress-testing" the index against the politically important factors of trade imbalance and legal immigration, quantify the systemic risk. For probability levels in the range of 5% to 10%, values of trade below these thresholds are associated with larger downward movements of the index than for immigration at the same level. The main intent of the index is to provide early-warning for negative changes in the mood of citizens, thus alerting policy makers and private agents to potential future market downturns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLatent Causal Socioeconomic Health Index

Anton H. Westveld, Swen Kuh, Grace S. Chiu

| Title | Authors | Year | Actions |

|---|

Comments (0)