Summary

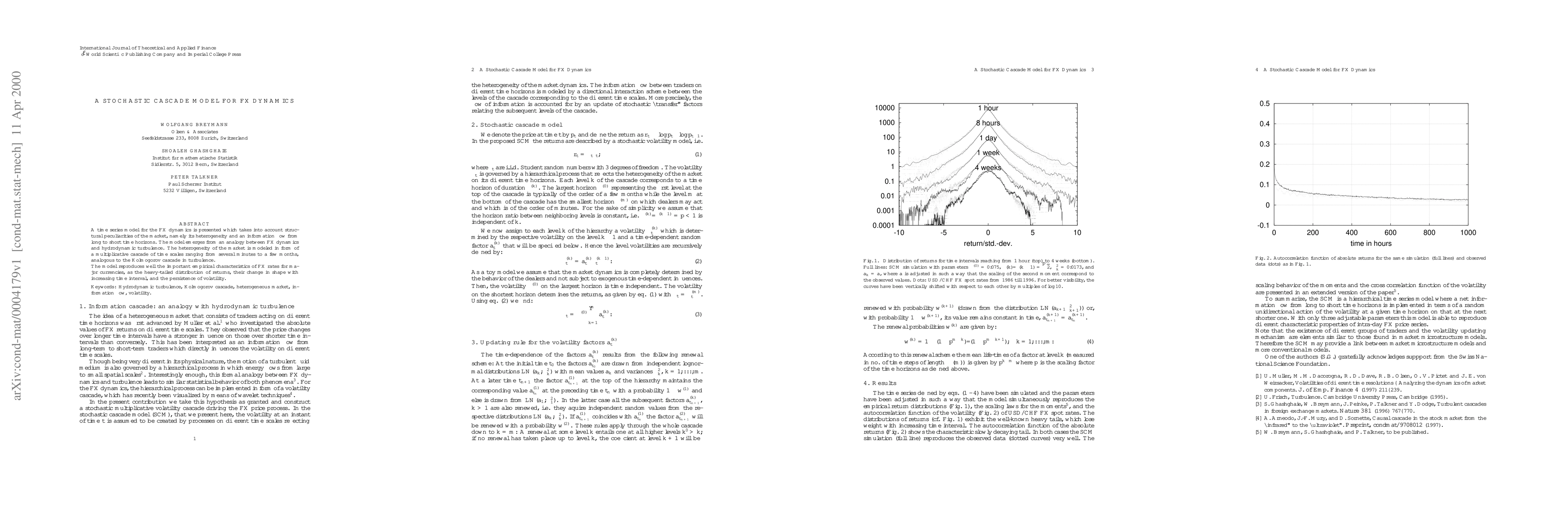

A time series model for the FX dynamics is presented which takes into account structural peculiarities of the market, namely its heterogeneity and an information flow from long to short time horizons. The model emerges from an analogy between FX dynamics and hydrodynamic turbulence. The heterogeneity of the market is modeled in form of a multiplicative cascade of time scales ranging from several minutes to a few months, analogous to the Kolmogorov cascade in turbulence. The model reproduces well the important empirical characteristics of FX rates for major currencies, as the heavy-tailed distribution of returns, their change in shape with increasing time interval, and the persistence of volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)