Summary

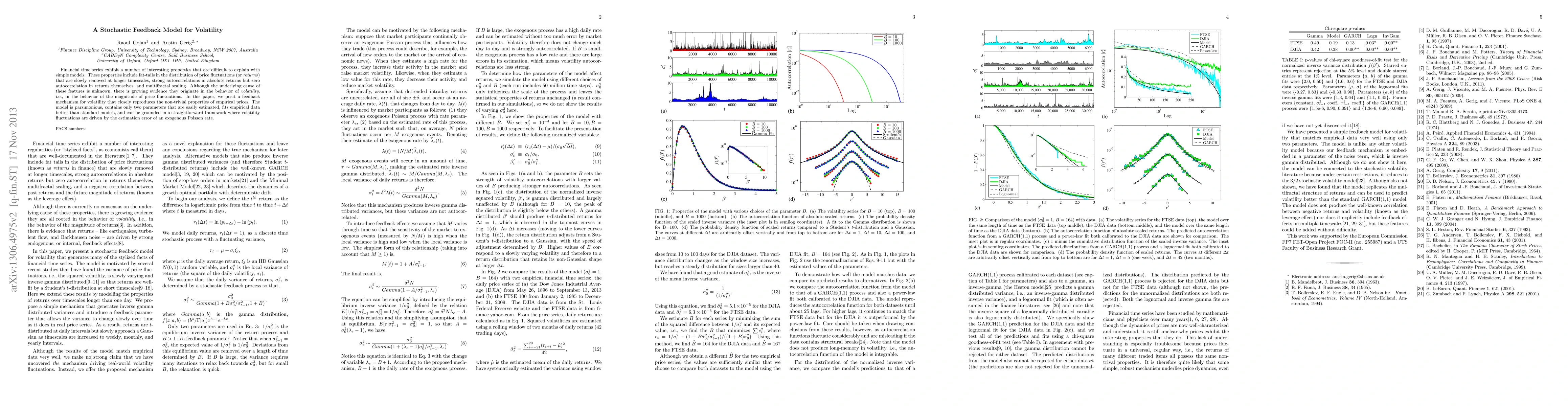

Financial time series exhibit a number of interesting properties that are difficult to explain with simple models. These properties include fat-tails in the distribution of price fluctuations (or returns) that are slowly removed at longer timescales, strong autocorrelations in absolute returns but zero autocorrelation in returns themselves, and multifractal scaling. Although the underlying cause of these features is unknown, there is growing evidence they originate in the behavior of volatility, i.e., in the behavior of the magnitude of price fluctuations. In this paper, we posit a feedback mechanism for volatility that closely reproduces the non-trivial properties of empirical prices. The model is parsimonious, contains only two parameters that are easily estimated, fits empirical data better than standard models, and can be grounded in a straightforward framework where volatility fluctuations are driven by the estimation error of an exogenous Poisson rate.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)