Summary

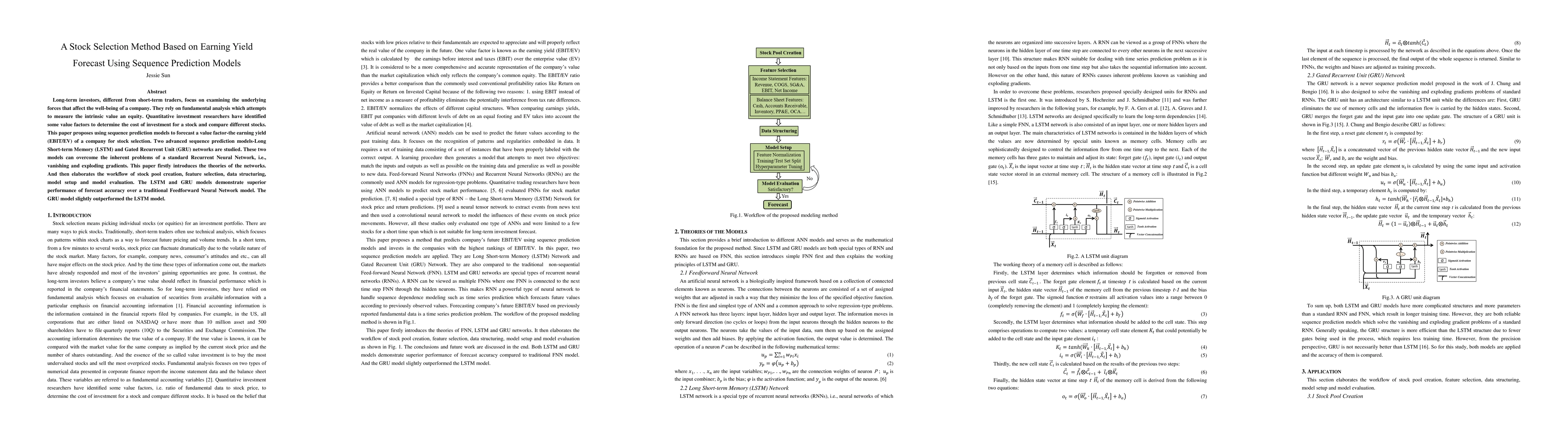

Long-term investors, different from short-term traders, focus on examining the underlying forces that affect the well-being of a company. They rely on fundamental analysis which attempts to measure the intrinsic value an equity. Quantitative investment researchers have identified some value factors to determine the cost of investment for a stock and compare different stocks. This paper proposes using sequence prediction models to forecast a value factor-the earning yield (EBIT/EV) of a company for stock selection. Two advanced sequence prediction models-Long Short-term Memory (LSTM) and Gated Recurrent Unit (GRU) networks are studied. These two models can overcome the inherent problems of a standard Recurrent Neural Network, i.e., vanishing and exploding gradients. This paper firstly introduces the theories of the networks. And then elaborates the workflow of stock pool creation, feature selection, data structuring, model setup and model evaluation. The LSTM and GRU models demonstrate superior performance of forecast accuracy over a traditional Feedforward Neural Network model. The GRU model slightly outperformed the LSTM model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTokenizing Stock Prices for Enhanced Multi-Step Forecast and Prediction

Haodong Chen, Xiaoming Chen, Qiang Qu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)