Summary

In this paper we present a statistical analysis about the characteristics that we intend to influence in the performance of the neural networks in terms of assertiveness in the prediction of Brazilian stock returns. We created a population of architectures for analysis and extracted the sample that had the best assertive performance. It was verified how the characteristics of this sample stand out and affect the neural networks. In addition, we make inferences about what kind of influence the different architectures have on the performance of neural networks. In the study, the prediction of the return of a Brazilian stock traded on the stock exchange of S\~ao Paulo to measure the error committed by the different architectures of constructed neural networks. The results are promising and indicate that some aspects of the neural network architecture have a significant impact on the assertiveness of the model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

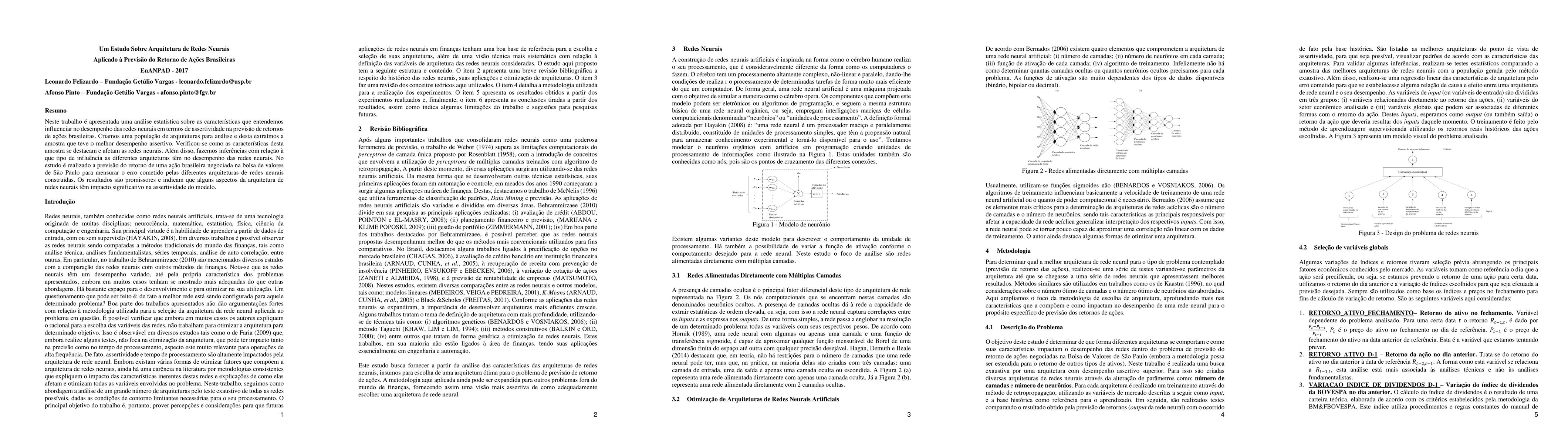

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-Horizon Echo State Network Prediction of Intraday Stock Returns

Petros Dellaportas, Giovanni Ballarin, Jacopo Capra

| Title | Authors | Year | Actions |

|---|

Comments (0)