Authors

Summary

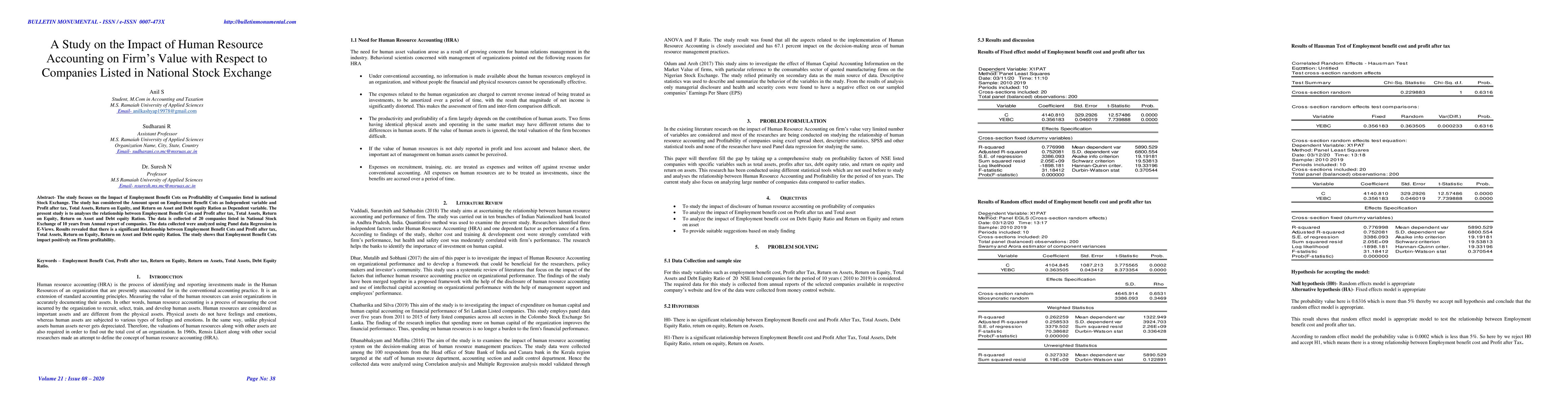

The study focuses on the Impact of Employment Benefit Cots on the Profitability of Companies listed in the National Stock Exchange. The study has considered the Amount spent on Employment Benefit Cots as an Independent variable and Profit after tax, Total Assets, Return on Equity, and Return on Asset and Debt equity Ration as the Dependent variable. The present study is to analyses the relationship between Employment Benefit Cots and Profit after tax, Total Assets, Return on Equity, Return on Asset, and Debt equity Ration. The data is collected from 20 companies listed on the National Stock Exchange for 10 years from the Annual reports of companies. The data collected were analyzed using Panel data Regression in E-Views. Results revealed that there is a significant Relationship between Employment Benefit Cots and Profit after tax, Total Assets, Return on Equity, Return on Asset, and Debt equity Ration. The study shows that Employment Benefit Cots impact positively on Firms profitability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Study on Impact of Environmental Accounting on Profitability of Companies listed in Bombay Stock Exchange

Sudharani R, Suresh N, Nandini E. S

A Study on Impact of Capital Structure on Profitability of Companies Listed in Indian Stock Exchange with respect to Automobile Industry

Sudharani R, Suresh N, P. Aishwarya

A Study on Impact of Downsizing on Profitability of Construction Industries listed in Bombay Stock Exchange (BSE) India

D Reshma, Sudharani R, Suresh N

| Title | Authors | Year | Actions |

|---|

Comments (0)