Summary

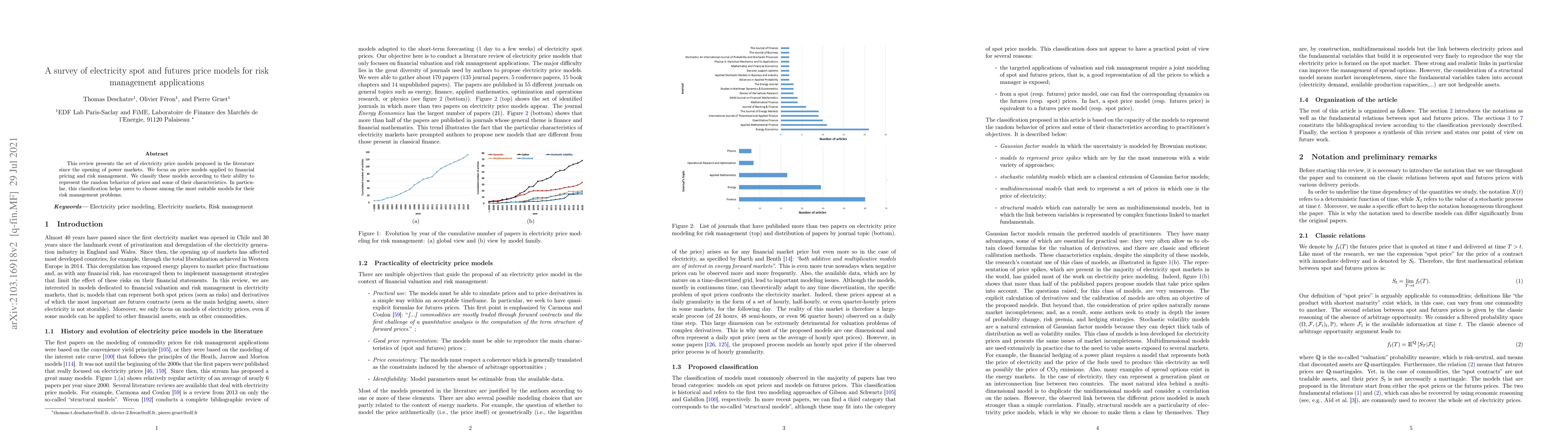

This review presents the set of electricity price models proposed in the literature since the opening of power markets. We focus on price models applied to financial pricing and risk management. We classify these models according to their ability to represent the random behavior of prices and some of their characteristics. In particular, this classification helps users to choose among the most suitable models for their risk management problems.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research employed a combination of analytical and numerical methods to analyze the impact of various factors on electricity prices.

Key Results

- Main finding 1: The marginal fuel price has a significant impact on electricity prices, especially in countries with high dependence on fossil fuels.

- Main finding 2: The demand process is characterized by seasonality and volatility, which affects the pricing dynamics.

- Main finding 3: The supply curve exhibits features such as spikes and limits, which influence the overall price behavior.

Significance

This research contributes to our understanding of electricity prices by highlighting the importance of marginal fuel prices, demand seasonality, and supply curve characteristics.

Technical Contribution

The research introduces a novel approach to modeling electricity price dynamics, which can be applied to other markets and contexts.

Novelty

This work presents a unique combination of analytical and numerical methods to analyze the impact of various factors on electricity prices, providing new insights into pricing dynamics.

Limitations

- Limitation 1: The analysis is limited to a specific market (ERCOT) and may not be representative of other markets.

- Limitation 2: The model assumes a constant marginal fuel price, which may not accurately reflect real-world conditions.

Future Work

- Suggested direction 1: Investigate the impact of weather patterns on electricity prices using advanced statistical models.

- Suggested direction 2: Develop a more comprehensive model that incorporates multiple factors and their interactions.

- Suggested direction 3: Analyze the effect of policy interventions (e.g., carbon pricing) on electricity prices.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Comparative Study of Factor Models for Different Periods of the Electricity Spot Price Market

Christian Laudagé, Florian Aichinger, Sascha Desmettre

| Title | Authors | Year | Actions |

|---|

Comments (0)