Summary

High-dimensional time series datasets are becoming increasingly common in many areas of biological and social sciences. Some important applications include gene regulatory network reconstruction using time course gene expression data, brain connectivity analysis from neuroimaging data, structural analysis of a large panel of macroeconomic indicators, and studying linkages among financial firms for more robust financial regulation. These applications have led to renewed interest in developing principled statistical methods and theory for estimating large time series models given only a relatively small number of temporally dependent samples. Sparse modeling approaches have gained popularity over the last two decades in statistics and machine learning for their interpretability and predictive accuracy. Although there is a rich literature on several sparsity inducing methods when samples are independent, research on the statistical properties of these methods for estimating time series models is still in progress. We survey some recent advances in this area, focusing on empirically successful lasso based estimation methods for two canonical multivariate time series models - stochastic regression and vector autoregression. We discuss key technical challenges arising in high-dimensional time series analysis and outline several interesting research directions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

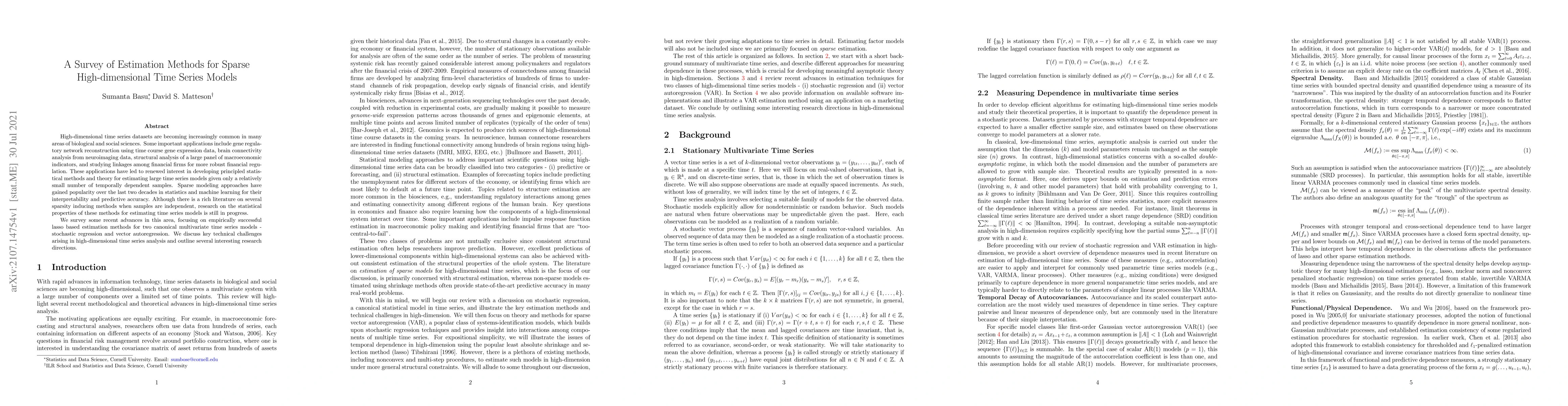

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Estimation of Sparse, High Dimensional Time Series with Polynomial Tails

George Michailidis, Sagnik Halder

| Title | Authors | Year | Actions |

|---|

Comments (0)