Authors

Summary

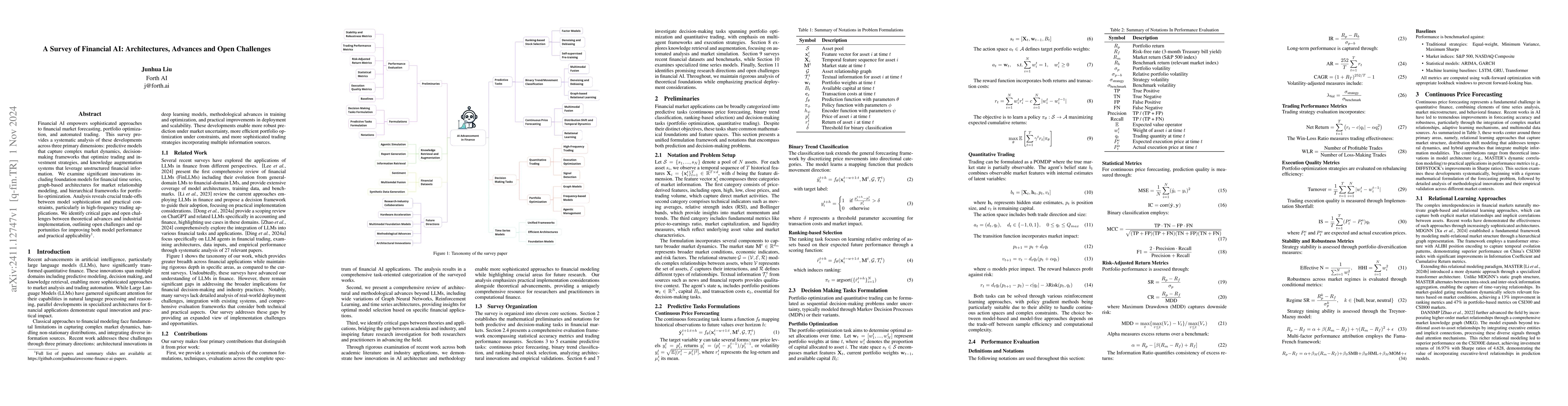

Financial AI empowers sophisticated approaches to financial market forecasting, portfolio optimization, and automated trading. This survey provides a systematic analysis of these developments across three primary dimensions: predictive models that capture complex market dynamics, decision-making frameworks that optimize trading and investment strategies, and knowledge augmentation systems that leverage unstructured financial information. We examine significant innovations including foundation models for financial time series, graph-based architectures for market relationship modeling, and hierarchical frameworks for portfolio optimization. Analysis reveals crucial trade-offs between model sophistication and practical constraints, particularly in high-frequency trading applications. We identify critical gaps and open challenges between theoretical advances and industrial implementation, outlining open challenges and opportunities for improving both model performance and practical applicability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Survey on Robotic Manipulation of Deformable Objects: Recent Advances, Open Challenges and New Frontiers

Bin He, Zhipeng Wang, Shuo Jiang et al.

The Role of AI in Financial Forecasting: ChatGPT's Potential and Challenges

Jue Xiao, Shuochen Bi, Tingting Deng

A Survey on Global LiDAR Localization: Challenges, Advances and Open Problems

Cyrill Stachniss, Yue Wang, Rong Xiong et al.

No citations found for this paper.

Comments (0)