Summary

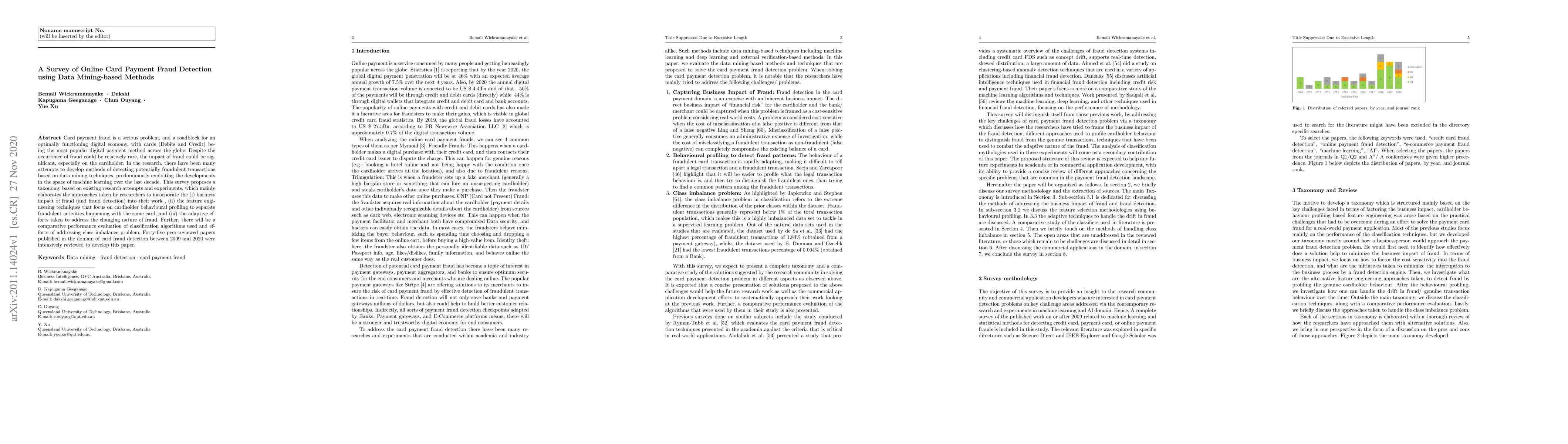

Card payment fraud is a serious problem, and a roadblock for an optimally functioning digital economy, with cards (Debits and Credit) being the most popular digital payment method across the globe. Despite the occurrence of fraud could be relatively rare, the impact of fraud could be significant, especially on the cardholder. In the research, there have been many attempts to develop methods of detecting potentially fraudulent transactions based on data mining techniques, predominantly exploiting the developments in the space of machine learning over the last decade. This survey proposes a taxonomy based on a review of existing research attempts and experiments, which mainly elaborates the approaches taken by researchers to incorporate the (i) business impact of fraud (and fraud detection) into their work , (ii) the feature engineering techniques that focus on cardholder behavioural profiling to separate fraudulent activities happening with the same card, and (iii) the adaptive efforts taken to address the changing nature of fraud. Further, there will be a comparative performance evaluation of classification algorithms used and efforts of addressing class imbalance problem. Forty-five peer-reviewed papers published in the domain of card fraud detection between 2009 and 2020 were intensively reviewed to develop this paper.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComparative Evaluation of Anomaly Detection Methods for Fraud Detection in Online Credit Card Payments

Hugo Thimonier, Fabrice Popineau, Arpad Rimmel et al.

Credit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

| Title | Authors | Year | Actions |

|---|

Comments (0)