Summary

Quantum computers are expected to surpass the computational capabilities of classical computers during this decade and have transformative impact on numerous industry sectors, particularly finance. In fact, finance is estimated to be the first industry sector to benefit from quantum computing, not only in the medium and long terms, but even in the short term. This survey paper presents a comprehensive summary of the state of the art of quantum computing for financial applications, with particular emphasis on stochastic modeling, optimization, and machine learning, describing how these solutions, adapted to work on a quantum computer, can potentially help to solve financial problems, such as derivative pricing, risk modeling, portfolio optimization, natural language processing, and fraud detection, more efficiently and accurately. We also discuss the feasibility of these algorithms on near-term quantum computers with various hardware implementations and demonstrate how they relate to a wide range of use cases in finance. We hope this article will not only serve as a reference for academic researchers and industry practitioners but also inspire new ideas for future research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

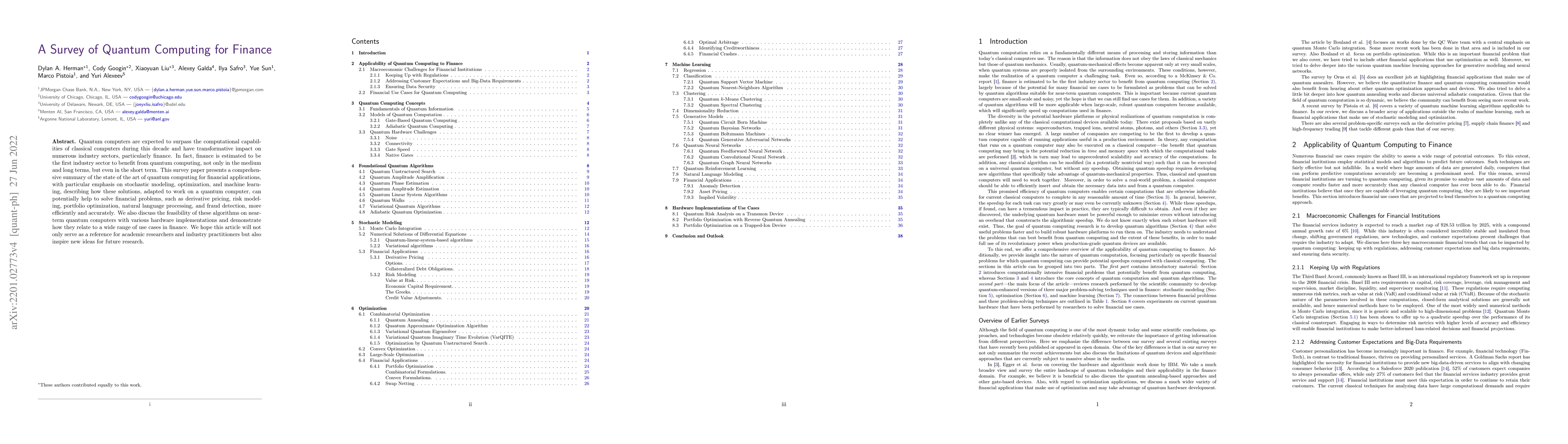

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Structured Survey of Quantum Computing for the Financial Industry

Esther Hänggi, Thomas Ankenbrand, Stefan Stettler et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)