Summary

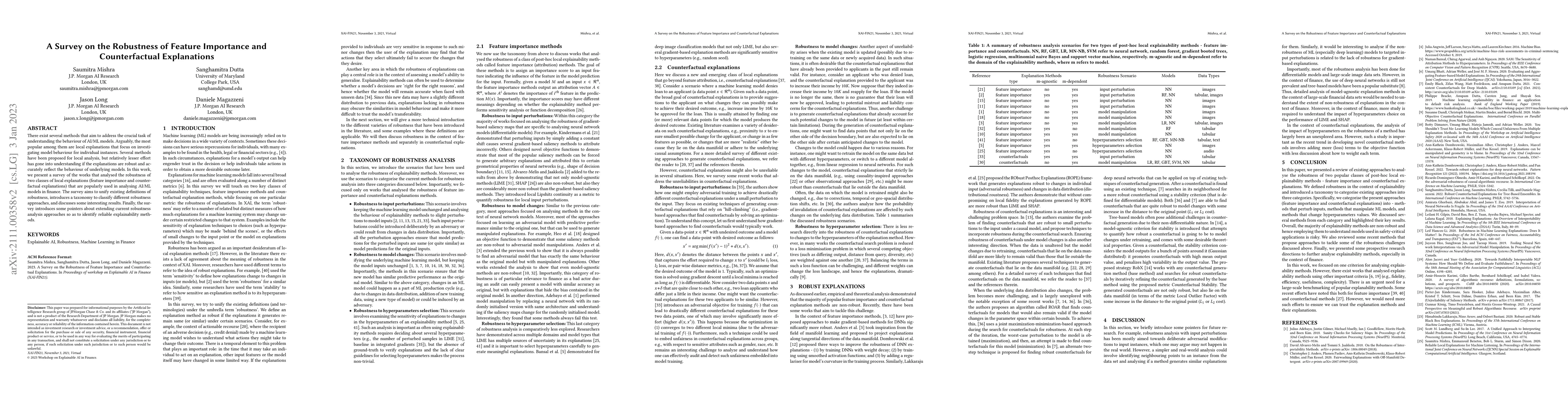

There exist several methods that aim to address the crucial task of understanding the behaviour of AI/ML models. Arguably, the most popular among them are local explanations that focus on investigating model behaviour for individual instances. Several methods have been proposed for local analysis, but relatively lesser effort has gone into understanding if the explanations are robust and accurately reflect the behaviour of underlying models. In this work, we present a survey of the works that analysed the robustness of two classes of local explanations (feature importance and counterfactual explanations) that are popularly used in analysing AI/ML models in finance. The survey aims to unify existing definitions of robustness, introduces a taxonomy to classify different robustness approaches, and discusses some interesting results. Finally, the survey introduces some pointers about extending current robustness analysis approaches so as to identify reliable explainability methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCalculating and Visualizing Counterfactual Feature Importance Values

David Martens, Bjorge Meulemeester, Raphael Mazzine Barbosa De Oliveira

On the Connection between Game-Theoretic Feature Attributions and Counterfactual Explanations

Shubham Sharma, Danial Dervovic, Daniele Magazzeni et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)