Authors

Summary

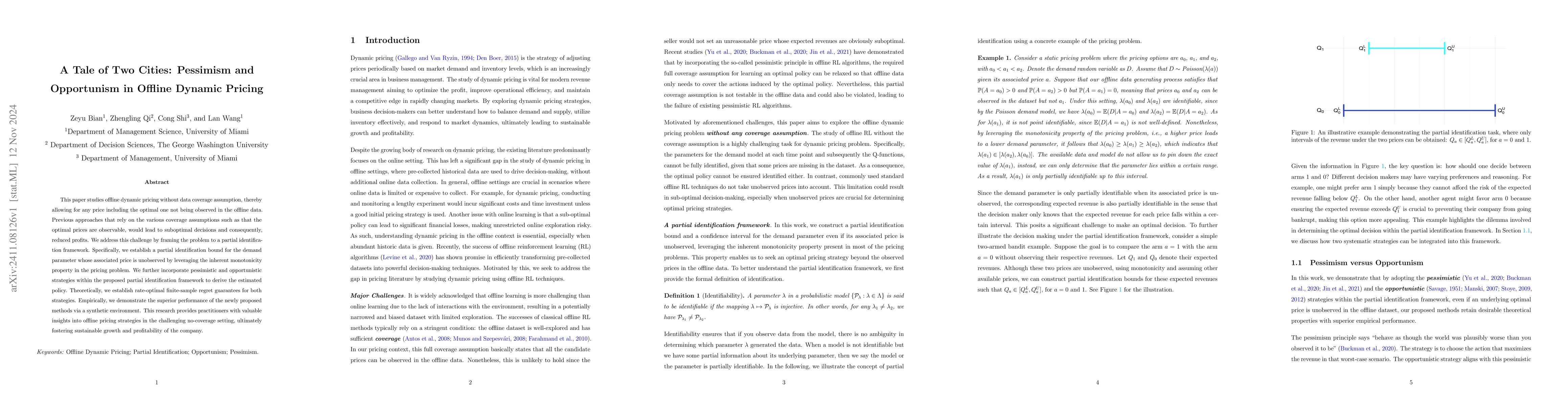

This paper studies offline dynamic pricing without data coverage assumption, thereby allowing for any price including the optimal one not being observed in the offline data. Previous approaches that rely on the various coverage assumptions such as that the optimal prices are observable, would lead to suboptimal decisions and consequently, reduced profits. We address this challenge by framing the problem to a partial identification framework. Specifically, we establish a partial identification bound for the demand parameter whose associated price is unobserved by leveraging the inherent monotonicity property in the pricing problem. We further incorporate pessimistic and opportunistic strategies within the proposed partial identification framework to derive the estimated policy. Theoretically, we establish rate-optimal finite-sample regret guarantees for both strategies. Empirically, we demonstrate the superior performance of the newly proposed methods via a synthetic environment. This research provides practitioners with valuable insights into offline pricing strategies in the challenging no-coverage setting, ultimately fostering sustainable growth and profitability of the company.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersBridging Offline Reinforcement Learning and Imitation Learning: A Tale of Pessimism

Jiantao Jiao, Cong Ma, Banghua Zhu et al.

Pessimism meets VCG: Learning Dynamic Mechanism Design via Offline Reinforcement Learning

Boxiang Lyu, Mladen Kolar, Zhuoran Yang et al.

Optimizing Pessimism in Dynamic Treatment Regimes: A Bayesian Learning Approach

Lexin Li, Chengchun Shi, Zhengling Qi et al.

Bellman-consistent Pessimism for Offline Reinforcement Learning

Nan Jiang, Alekh Agarwal, Tengyang Xie et al.

Comments (0)