Summary

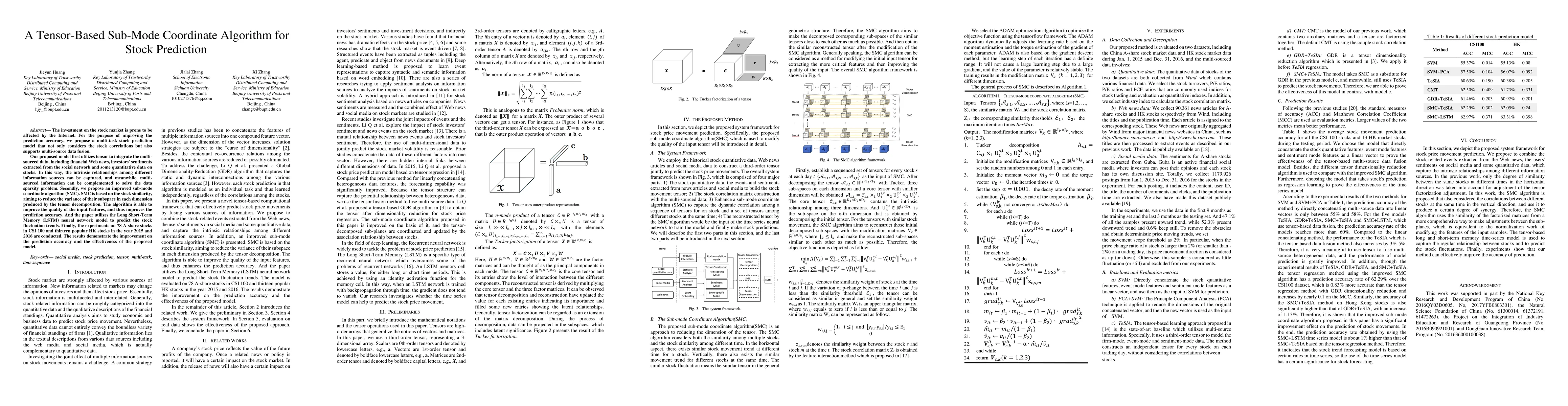

The investment on the stock market is prone to be affected by the Internet. For the purpose of improving the prediction accuracy, we propose a multi-task stock prediction model that not only considers the stock correlations but also supports multi-source data fusion. Our proposed model first utilizes tensor to integrate the multi-sourced data, including financial Web news, investors' sentiments extracted from the social network and some quantitative data on stocks. In this way, the intrinsic relationships among different information sources can be captured, and meanwhile, multi-sourced information can be complemented to solve the data sparsity problem. Secondly, we propose an improved sub-mode coordinate algorithm (SMC). SMC is based on the stock similarity, aiming to reduce the variance of their subspace in each dimension produced by the tensor decomposition. The algorithm is able to improve the quality of the input features, and thus improves the prediction accuracy. And the paper utilizes the Long Short-Term Memory (LSTM) neural network model to predict the stock fluctuation trends. Finally, the experiments on 78 A-share stocks in CSI 100 and thirteen popular HK stocks in the year 2015 and 2016 are conducted. The results demonstrate the improvement on the prediction accuracy and the effectiveness of the proposed model.

AI Key Findings

Generated Sep 05, 2025

Methodology

The proposed system framework combines stock-related events extracted from Web news, users' sentiments on social media, and quantitative data to predict stock price movements.

Key Results

- Improved accuracy of prediction compared to existing methods

- Enhanced ability to capture intrinsic relationships among different information sources

- Development of a novel SMC algorithm for synergy between sub-planes

Significance

The research has significant implications for improving stock market prediction and decision-making.

Technical Contribution

The proposed SMC algorithm provides a novel approach for synergy between sub-planes, improving the accuracy and robustness of stock market prediction.

Novelty

The research introduces a new method for combining multiple information sources to predict stock price movements, offering a more comprehensive understanding of the underlying factors.

Limitations

- Limited dataset size and potential biases

- Complexity of incorporating multiple information sources

Future Work

- Exploring the application of SMC algorithm to other financial markets

- Investigating the effect of social media on stock price movements

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeta-Stock: Task-Difficulty-Adaptive Meta-learning for Sub-new Stock Price Prediction

Qianli Ma, Zhen Liu, Linghao Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)