Authors

Summary

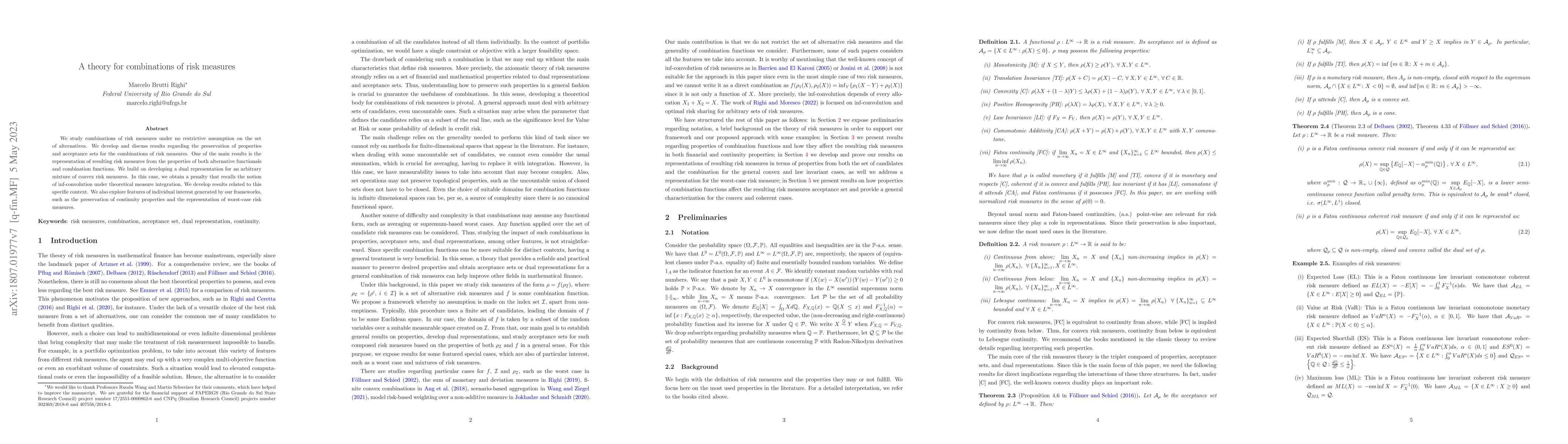

We study combinations of risk measures under no restrictive assumption on the set of alternatives. We develop and discuss results regarding the preservation of properties and acceptance sets for the combinations of risk measures. One of the main results is the representation of resulting risk measures from the properties of both alternative functionals and combination functions. We build on developing a dual representation for an arbitrary mixture of convex risk measures. In this case, we obtain a penalty that recalls the notion of inf-convolution under theoretical measure integration. We develop results related to this specific context. We also explore features of individual interest generated by our frameworks, such as the preservation of continuity properties and the representation of worst-case risk measures.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper develops a theory for combinations of risk measures without restrictive assumptions on the set of alternatives, focusing on preservation of properties and acceptance sets for the combinations.

Key Results

- A representation of resulting risk measures from the properties of both alternative functionals and combination functions.

- Dual representation for an arbitrary mixture of convex risk measures, leading to a penalty reminiscent of inf-convolution under theoretical measure integration.

- Preservation of continuity properties and representation of worst-case risk measures.

- Characterization of acceptance sets for composed risk measures, particularly for convex risk measures and under conditions like monotonicity, translation invariance, coherence, and law invariance.

Significance

This research contributes to the understanding of risk measure combinations, which is crucial for financial modeling and risk management, providing a framework that can accommodate a wide range of risk measures and ensuring important properties are preserved.

Technical Contribution

The paper introduces a dual representation for mixed convex risk measures and provides a general characterization for acceptance sets of composed risk measures, particularly for convex ones.

Novelty

The work extends existing theories by providing a comprehensive analysis of combinations of risk measures under minimal assumptions, offering new insights into the preservation of properties and the structure of acceptance sets.

Limitations

- The study assumes certain properties for risk measures and combination functions, which may limit its applicability to all types of risk measures.

- The theoretical results may not directly translate to practical applications without further considerations.

Future Work

- Investigating the implications of these theoretical findings in practical financial modeling and risk assessment scenarios.

- Exploring extensions of the framework to accommodate non-convex risk measures and more complex combination functions.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCoherent estimation of risk measures

Igor Cialenco, Marcin Pitera, Damian Jelito et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)