Summary

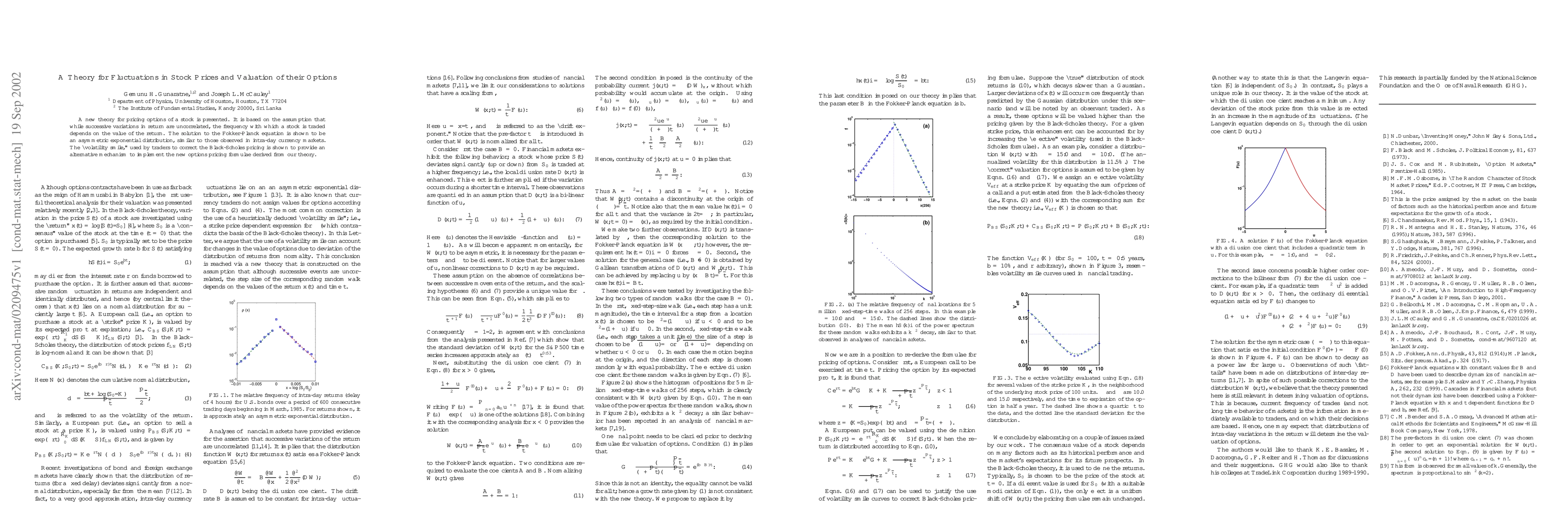

A new theory for pricing options of a stock is presented. It is based on the assumption that while successive variations in return are uncorrelated, the frequency with which a stock is traded depends on the value of the return. The solution to the Fokker-Planck equation is shown to be an asymmetric exponential distribution, similar to those observed in intra-day currency markets. The "volatility smile," used by traders to correct the Black-Scholes pricing is shown to provide an alternative mechanism to implement the new options pricing formulae derived from our theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)