Authors

Summary

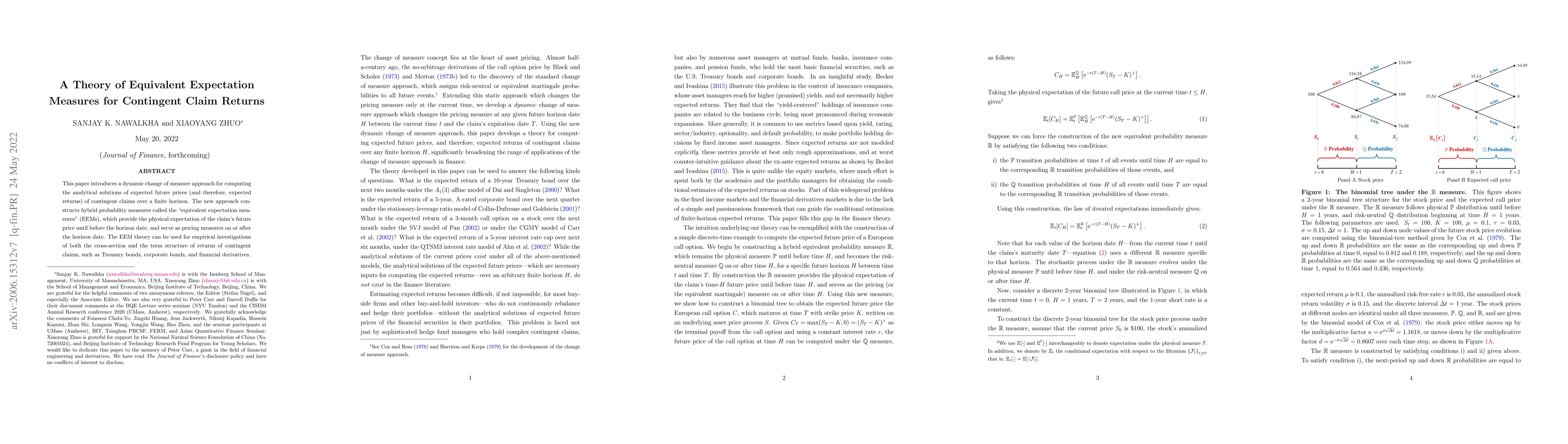

This paper introduces a dynamic change of measure approach for computing the analytical solutions of expected future prices (and therefore, expected returns) of contingent claims over a finite horizon. The new approach constructs hybrid probability measures called the "equivalent expectation measures"(EEMs), which provide the physical expectation of the claim's future price until before the horizon date, and serve as pricing measures on or after the horizon date. The EEM theory can be used for empirical investigations of both the cross-section and the term structure of returns of contingent claims, such as Treasury bonds, corporate bonds, and financial derivatives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolios Generated by Contingent Claim Functions, with Applications to Option Pricing

Ricardo T. Fernholz, Robert Fernholz

| Title | Authors | Year | Actions |

|---|

Comments (0)