Summary

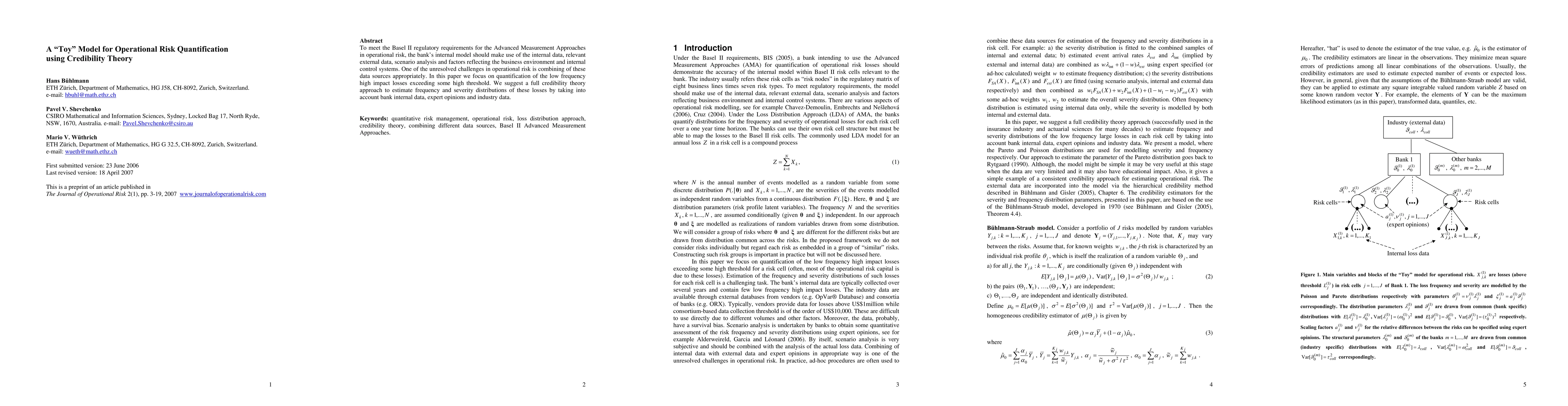

To meet the Basel II regulatory requirements for the Advanced Measurement Approaches in operational risk, the bank's internal model should make use of the internal data, relevant external data, scenario analysis and factors reflecting the business environment and internal control systems. One of the unresolved challenges in operational risk is combining of these data sources appropriately. In this paper we focus on quantification of the low frequency high impact losses exceeding some high threshold. We suggest a full credibility theory approach to estimate frequency and severity distributions of these losses by taking into account bank internal data, expert opinions and industry data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOperational risk quantification of power grids using graph neural network surrogates of the DC OPF

Yadong Zhang, Pranav M Karve, Sankaran Mahadevan

Operational Theories in Phase Space: Toy Model for the Harmonic Oscillator

Matthias Kleinmann, Martin Plávala

| Title | Authors | Year | Actions |

|---|

Comments (0)