Summary

Bayesian analysis of state-space models includes computing the posterior distribution of the system's parameters as well as filtering, smoothing, and predicting the system's latent states. When the latent states wander around $\mathbb{R}^n$ there are several well-known modeling components and computational tools that may be profitably combined to achieve these tasks. However, there are scenarios, like tracking an object in a video or tracking a covariance matrix of financial assets returns, when the latent states are restricted to a curve within $\mathbb{R}^n$ and these models and tools do not immediately apply. Within this constrained setting, most work has focused on filtering and less attention has been paid to the other aspects of Bayesian state-space inference, which tend to be more challenging. To that end, we present a state-space model whose latent states take values on the manifold of symmetric positive-definite matrices and for which one may easily compute the posterior distribution of the latent states and the system's parameters, in addition to filtered distributions and one-step ahead predictions. Deploying the model within the context of finance, we show how one can use realized covariance matrices as data to predict latent time-varying covariance matrices. This approach out-performs factor stochastic volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

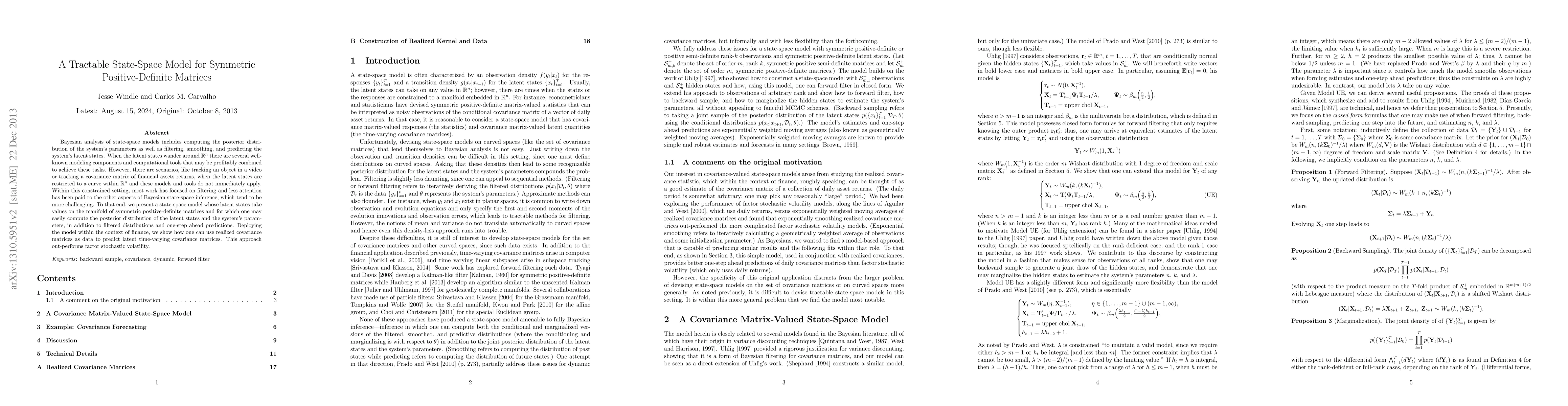

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAveraging symmetric positive-definite matrices on the space of eigen-decompositions

Armin Schwartzman, Sungkyu Jung, David Groisser et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)